As a first-time homebuyer, choosing between FHA and conventional loans can seem like a gamble. You don’t want to end up stuck in the wrong loan.

There’s no “right answer” when it comes to this issue. It depends on your situation.

So, following are 12 scenarios. Simply read the one that best matches your profile.

Check your eligibility for FHA or conventional.

I have good credit and at least 5% down

Buyers with decent credit and some amount of down payment should choose a conventional loan. Benefits include:

- A better chance at an accepted offer

- Cancelable mortgage insurance

- No 1.75% FHA upfront mortgage insurance fee

You can even get a conventional loan for 3% down. However, private mortgage insurance (PMI) will be more expensive and some programs come with income limits.

My credit isn’t bad but not good either. I have 3-5% down

Those in the 640-700 credit score camp might choose FHA even if they qualify for conventional.

FHA mortgage insurance (MIP) is significantly cheaper and you’ll get a much better rate.

FHA is not as sensitive to credit scores as conventional. First, its mortgage insurance is not risk-based. Nearly everyone pays 0.55% of the loan amount per year but conventional PMI can range from 0.40% to nearly 2.0% per year.

Second, FHA does not charge Fannie Mae’s Loan Level Price Adjustments (LLPAs) which increase conventional rates for credit scores below 740.

I want to cancel PMI at some point

If you don’t want to pay PMI forever, either program will work.

FHA requires monthly mortgage insurance as long as you have the loan in most cases. But first-time buyers generally refinance out of FHA into conventional when they reach 20% equity.

Since most people only hold the home or mortgage 5-7 years, you probably won’t be locked into PMI for life.

Conventional loans allow PMI removal without refinancing. This could help you avoid refinancing fees and hassle in the future.

I have a large down payment or hefty gift funds

Someone with 10% down or more should try for conventional.

PMI is very cheap with at least 10% down. Plus, you’ll probably hit 20% equity in a few years at which point you simply cancel PMI.

You also enjoy other advantages: better chances of an accepted offer and no FHA upfront MIP.

Another option is the 80-10-10 piggyback loan. You take on a second mortgage for 10% of the home’s price and avoid PMI altogether.

Get approved for a conventional loan. Start here.

I have a strong profile and I’m in a competitive market

Choose a conventional loan in competitive markets if it’s an option.

Sellers with multiple offers typically weed out FHA buyers first. There’s a misconception that FHA buyers are more shaky financially. And, sellers are concerned that the home won’t pass the FHA appraisal.

Even with a low down payment, a conventional loan offer looks better than FHA to the seller.

I need down payment assistance

Both conventional and FHA loans allow down payment assistance (DPA) programs. However, FHA is the better choice for more flexibility.

There are nationwide DPA loans with no income limits. Lenders use FHA as the base program and add the DPA features.

I make a moderate income

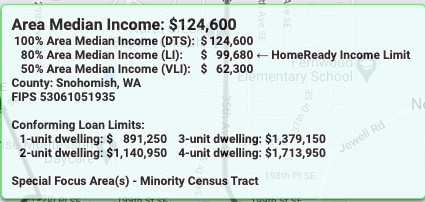

Fannie Mae recently introduced a moderate-income discount for first-time buyers.

Someone making 100% or less of their area median income (120% or less in high-cost areas) gets all their LLPAs waived. This could mean a 0.50% to 1.0% lower rate for someone with a low-to-moderate income.

With the discount, conventional loan rates are competitive with FHA even for those with sub-par credit scores.

Check your area median income with Fannie Mae’s tool. See whether your income is below the 100% or 120% level as in the example below.

The home I’m considering is kind of beat up and I want to DIY after closing

Those looking to do DIY repairs after closing should try for a conventional loan.

Conventional is more forgiving about property condition. Whereas the FHA appraiser may require repairs before closing, some issues can be dealt with after closing with conventional.

Both programs offer renovation loans with which you can finance post-closing repairs. However, these require the work to be done by a contractor.

I want a major fixer upper

For a home that needs major repairs, you could choose either FHA or conventional. Both offer programs to finance the purchase price plus renovation costs. Repairs are made after closing.

FHA offers the 203k renovation loan to finance 96.5% of the home price plus repair costs.

Conventional loans offer Freddie Mac’s CHOICERenovation and Fannie Mae’s HomeStyle. Both options allow for as little as 3% down.

See if you qualify for a renovation loan.

The house may not appraise for the asking price

If you suspect that the appraisal will come in under the purchase price, conventional loans are better.

Sellers are unlikely to accept an FHA offer if there’s a chance of an appraisal gap. FHA allows the buyer to walk away from the deal without penalty if it doesn’t appraise. Plus, sellers suspect an FHA buyer doesn’t have the funds to cover an appraisal shortfall.

It’s not always smart to pay more than the appraised value. But if this is common in your market, you should try to qualify for conventional first.

I’m buying a condo

Conventional loans are better for condo buying. The condo complex must be on FHA’s approved list to qualify for financing. Conventional loans only require the HOA to complete a questionnaire.

If you need an FHA loan for a condo, you can attempt to get a Single Unit Approval.

I’m getting quoted a 1% lower rate for FHA

FHA loans come with lower rates due to an explicit government backing that reimburses lenders in case of default.

Conventional loans don’t have this strong guarantee, resulting in higher rates.

On the surface, FHA may seem cheaper. But you still might consider a conventional loan because:

- FHA tacks on a 1.75% fee to the loan amount, over $5,000 on a $300,000 loan. This reduces your home equity and raises your payment

- You can cancel conventional PMI without a refinance which could save you thousands in loan fees in the future

- Your offer may be accepted faster, potentially saving you thousands in rent costs

Get help deciding

Should you get cost estimates for both programs? Certainly. But look beyond the rate. Examine financed costs, future expenses, and opportunity costs when considering FHA.