A USDA home loan is a fantastic homebuying tool, offering zero down payment, low rates, and lenient credit score guidelines.

But in return, they come with some extra stipulations, such as how you must occupy the property and your household income.

So, can you have a roommate if you get a USDA loan?

Let’s talk about a few scenarios.

1. You currently have a roommate who will live with you in the new home.

2. You plan to find a roommate after you buy the house.

3. You plan to rent out the entire home

First, let’s clarify a couple things:

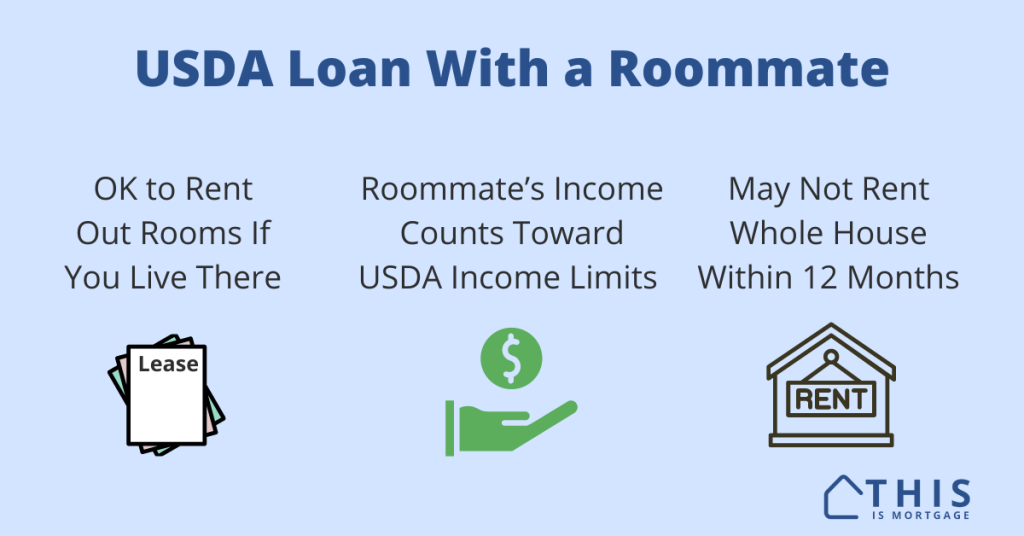

USDA loan occupancy requirements: USDA requires the home to be your primary residence. You must move in within 60 days of closing and live there full-time for 12 months. The fact that you will have a roommate in the new home does not make it a rental property. It is still your primary residence. However, you can’t rent out the entire house for 12 months.

Household income: USDA adds up all income in the household, including roommates, to determine whether you meet income requirements.

Knowing that, let’s see if you can have a roommate with a USDA loan.

Start your USDA home loan with a no-pressure conversation here.

1. You currently have a roommate who will live with you in the new home

USDA will consider your roommate’s income as “household income” even if he or she is not on the loan.

Maximum household annual income for most areas of the country is $110,650 until June 2024, when income limits might rise. The limit is higher in high-cost areas. It’s very possible a roommate can push you over income limits, similar to when a girlfriend or boyfriend moves in.

You also must count any rent the roommate pays you as part of your household income.

If the roommate makes you ineligible income-wise, you have two choices:

1. Live in the house with no roommate

2. Get a different loan type and have the roommate continue to live with you.

If you don’t want the roommate to continue living with you in the new home, they will have to certify as much to the lender. The lender should be okay with a letter of explanation. Check with your lender to make sure.

If the roommate will stay, and their income pushes you over limits, you can still buy a house. Make a down payment of 3% for a conventional loan or 3.5% for FHA; neither comes with income limits. Or find a down payment assistance program with no income limits.

Related: I’m Getting a USDA Loan and My Girlfriend Moved In

You might wonder if you can have a current roommate move back in with you after closing. This is a gray area at best, and mortgage fraud at worst. Be careful and know the risks if you plan to make untrue statements to the lender.

Get started on your USDA home loan. Find your lender here.

2. You plan to find a roommate after you buy the house

What if you don’t have a roommate now, but you want to find one after you buy to help defray costs?

This would not turn the home into a rental property. It would remain your primary residence as long as you continue to live there.

Related: Getting a Roommate with an FHA Loan

The bigger issue is with household income qualification. Any household income that you may receive within 12 months of moving in could push you over income limits for the USDA program.

You could include a proposed roommate’s income and rent to the application if your combined income is under USDA limits.

But, if it’s just an idea at this point, there’s no way to know your future roommate’s income or what they will pay you in rent. So even if you wanted to verify that you will still be under income limits, it would be impossible.

If it’s still just an “idea,” the best plan is not to plan. Buy the house, move in. If it turns out that you want or need a roommate in the future, you should be fine. For the USDA Guaranteed program (the one you get from a mortgage company or lender), there is no post-closing check for household income changes.

Things are different for the USDA Direct loan, the program you get directly from the government agency, which is designed for very-low-income applicants. There IS an annual review of income. Additional household income will change your mortgage payment. So getting a roommate later will affect your loan.

That being said, the Direct program is very rare and most people use the Guaranteed program.

3. You plan to rent out the entire home after closing

Renting out the entire home within 12 months is clearly against USDA rules and could get you in hot water for mortgage fraud.

Lenders understand that life happens, but there’s no way to prove you didn’t plan on renting out the home when you purchased it. The fact that it’s rented out within 12 months violates the contract you signed at closing.

The best plan here is to live in the home for 12 months. Then, you can do whatever you want with it.

Getting a roommate with a USDA loan FAQ

You will still be eligible for a USDA loan if your and your roommate’s combined incomes are below limits. You are allowed to have a roommate or boarder in the new home as long as you, the borrower, plan to live there full-time for 12 months.

A romantic partner must move out of your existing living arrangement for 3 months and it must be documented before you can remove the partner from household income calculations.

The lender should accept a certification that the current roommate won’t live with you in the new home. Check with your lender in case they require documentation of a new living arrangement for the current roommate.

USDA loan roommate scenarios

| Current | Future | Action |

|---|---|---|

| You have a roommate | The roommate will live in the new home. | Document roommate’s income and rent payments. Ensure combined incomes are below USDA limits. |

| You have a roommate | The roommate will not live in the new home. | Have the roommate certify they will not follow you to the new home. |

| No roommate | You have a roommate lined up for the new home. | Document new roommate’s income and rent payment. Ensure combined incomes are below USDA limits. Consider not having the roommate if their income pushes you over USDA limits. |

| No roommate | Future roommate is just an idea at this point. | Create no plans around a future roommate. Buy the house and move in. No need to mention to the lender what is only a possibility. |

| Girlfriend/boyfriend lives with you | Will continue to live with you | Romantic relationships are different than roommates. See more info here. |

USDA income eligibility: a sticky subject

The USDA wants to reserve this zero-down program for those who need it most. That’s why there are income limits. While it might be tempting to hide a current roommate or household member from your lender to skirt under income limits, it’s not a good idea.

However, the mere possibility of a roommate at some time in the future is best left unsaid.

See if you’re eligible for a zero-down USDA loan. Speak to a lender here.