It’s normal for a mortgage underwriter to ask for a letter of explanation, also called an LOX or LOE, about a potential issue in your loan file.

Here’s a general template that will help you address various circumstances. Be sure also to check below for specific letters of explanation that cover things like long commutes, employment gaps, large bank deposits, and more.

Sample mortgage letter of explanation template download

>>Download the Word document here

>>Download the PDF here (requires PDF editor to edit)

Specific letters of explanation

Check below for templates that match your situation or see our library of all letter of explanation templates

- Commute explanation letter

- Remote work explanation letter

- Employment gap explanation letter

- Large bank deposit explanation letter

- Down payment gift funds letter

- Relationship explanation letter

- Address discrepancy letter

- Credit inquiries explanation letter

- Derogatory credit explanation letter

- Cash-out refinance explanation letter

Why does the underwriter need a letter of explanation?

As you can see above, there are almost limitless situations that may require a letter.

Underwriters are required to track down any unanswered questions that may jeopardize the loan approval. Questions could arise about credit, income, employment, bank accounts, ownership of other properties, and more.

Your immediate reaction to some of these requests might be “none of your business.” However, underwriters don’t particularly like asking for more documents.

They are responsible for uncovering issues that might jeopardize your ability to repay the loan. For example, owning another property with a mortgage might cause your budget to be stretched too far.

Or, a situation may not adhere to program guidelines. Your underwriter may ask about your relationship to a person on a bank statement or lease. Seems nosy, right?

Then you find out that your loan is subject to income limits. If someone else is living with you, your household income may be too high.

Then there are more obvious reasons, such as a past bankruptcy or credit issues.

There’s always a good reason, as nosy as the request might seem.

Mortgage letter of explanation formula

Here’s what underwriters are looking for:

- What happened? All the facts. Include dates, dollar amounts, and circumstances. Be honest and don’t try to hide personal responsibility.

- Resolution: How did you resolve the situation?

- Won’t happen again: How was this a one-time event and not likely to happen again? Or how have you changed past behavior?

Additional tips:

If possible, explain how the event was outside your control: You’ll get a lot of grace if you explain why something was not of your own doing. For example, you were hit by a drunk driver, lost your job, and were unable to pay bills. However, be honest if you were just a bad money manager in the past.

Provide documentation: It’s also a good idea to provide doctor’s bills, lease agreements, credit payoff letters, or other documentation needed to prove your claims.

Mortgage letter of explanation case study

Let’s see how the above example letter follows the formula.

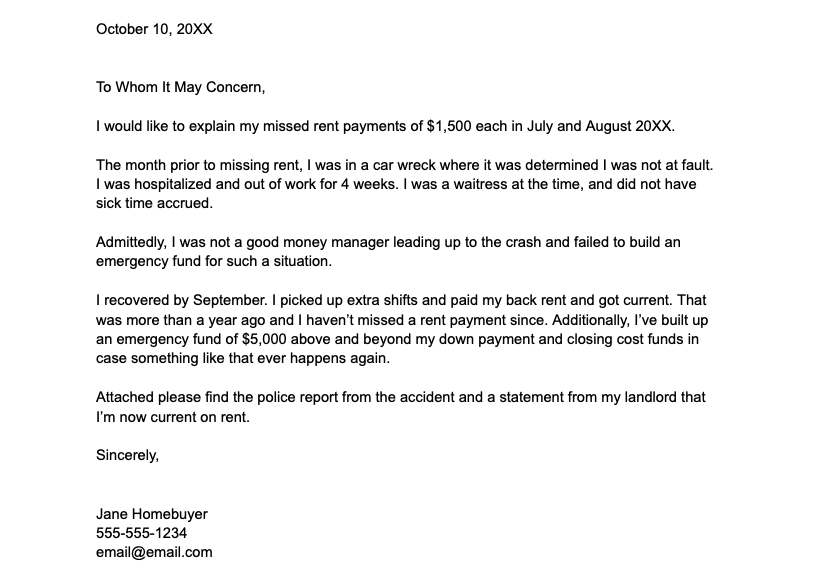

I would like to explain my missed rent payments of $1,500 each in July and August 20XX. (Jane details the facts including dollar amounts and dates)

The month prior to missing rent, I was in a car wreck where it was determined I was not at fault. I was hospitalized and out of work for 4 weeks. I was a waitress at the time, and did not have sick time accrued. (Jane shows how at least part of the circumstance was outside her control.)

Admittedly, I was not a good money manager leading up to the crash and failed to build an emergency fund for such a situation. (She admits she could have prepared for an emergency better. This builds good faith with the underwriter.)

I recovered by September. I picked up extra shifts and paid my back rent and got current. That was more than a year ago and I haven’t missed a rent payment since. Additionally, I’ve built up an emergency fund of $5,000 above and beyond my down payment and closing cost funds in case something like that ever happens again. (She shows how she fully recovered and demonstrated changed behavior. She also shows how she is making sure the situation doesn’t re-occur.)

Attached please find the police report from the accident and a statement from my landlord that I’m now current on rent. (Jane includes documentation to support claims.)

Sincerely,

Jane Homebuyer

A letter of explanation is not usually reason to worry

Most of the time, a decent letter of explanation will be accepted with no further questions.

If not, simply write further explanations until the underwriter is satisfied.

Usually, though, you’ll submit your LOE and that will be the end of it.