If you have a regular W-2 job, usually you just have to submit pay stubs and W-2s to your lender.

But things change if you work for a family-owned business.

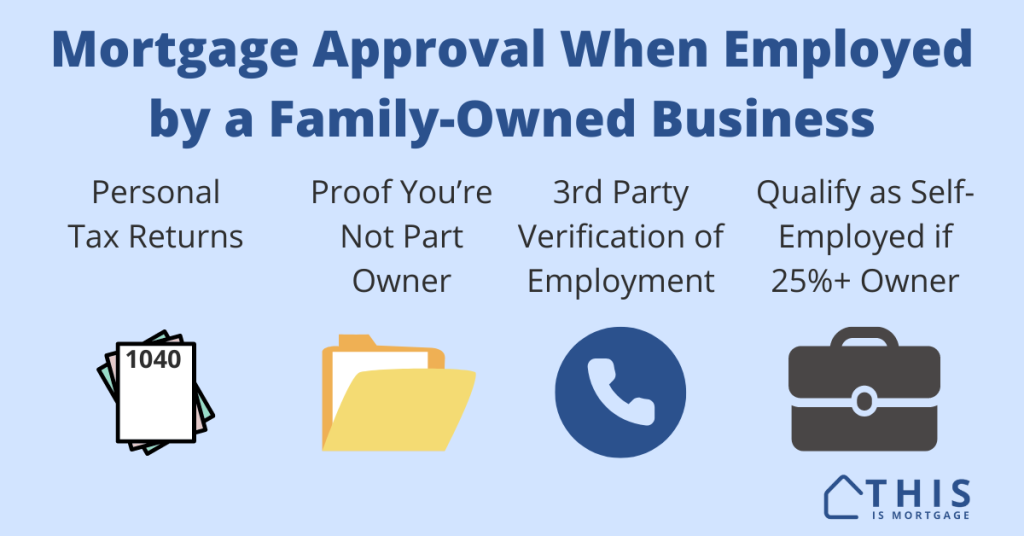

Then, lenders may need some additional information.

First, they want to know if you are part owner of the business.

Additionally, they want to make sure none of the income documentation is “doctored” to inflate your qualifying income.

While you would probably never do this, lenders still make you jump through a few hoops if you are employed by family. Here’s what to know.

See if you can qualify for a mortgage as a family business employee.

- Are you an owner of the business?

- Documentation needed when employed by family

- Conventional loans (Fannie Mae and Freddie Mac) when employed by family

- FHA and a family-owned business

- Getting a VA loan when working for family

- USDA loan rules for employees of family businesses

- Pending job offer from a family business

- Work for a family business? You can still qualify

Are you an owner of the business?

The first item the lender will check is whether you own a part of the business.

If not, it can likely use your W-2 earnings to qualify you.

But a borrower who owns 25% or more of a business is considered self-employed. The lender will need two years of personal and business tax returns and you need to show two years of ownership.

This is true even if you earn W-2 income along with business income.

The lender wants to know whether the business makes enough money to pay you W-2 earnings. For example, if you earn $100,000 per year from a family business that only brings in $90,000, that’s not sustainable.

Even if you own a small portion of the business, the lender will check whether that ownership results in an income gain or loss each year.

Check your mortgage eligibility.

Documentation needed when employed by family

The documentation required will vary based on the loan type you’re getting. It may also change slightly from lender to lender.

Whereas some lenders underwrite loans strictly “by the book,” others “overlay” additional rules on top of official guidebooks.

The below should give you a good idea of what lenders might ask for.

Conventional loans (Fannie Mae and Freddie Mac) when employed by family

- Two years of tax returns for Fannie Mae

- One year of tax returns for Freddie Mac

- Preferably, a verification of employment by a third-party service such as The Work Number

The tax returns are to prove you have no income from business ownership, only from W-2 earnings.

The lender will request a verification of employment from the business. Expect additional prying since it’s likely a family member or someone who could be influenced by family who will be verifying your employment.

See if you qualify for a conventional loan.

FHA and a family-owned business

FHA is more strict than conventional on this matter. You’ll need:

- A corporate resolution, business organization documents, business tax returns, Schedule K-1, or CPA letter on letterhead verifying you are not an owner of the business

- Personal tax returns

- Preferably, third-party verification of employment

If you are not an owner, the lender will use your salary amount as qualifying income. If you are paid hourly and your work hours vary, the lender will average the last one to two years of income. The lender will follow similar guidelines as required for part-time income.

If you own more than 25% of the business, you will need to qualify for the loan based on FHA’s self-employed mortgage requirements.

Check your eligibility for FHA as a family business employee.

Getting a VA loan when working for family

While VA guidelines don’t specifically call out requirements for employees of family-owned businesses, expect additional questions and documentation including:

- Minimum one year of work history at the family-owned business

- Personal tax returns showing no business ownership income

- Two years of business and personal tax returns if you own 25% or more of the business

- Third-party verification of employment

USDA loan rules for employees of family businesses

The lender could request personal tax returns if it suspects you work for a family-owned business.

If you have no ownership, it will use standard W-2 income for qualifying.

If you 25% or greater owner, the lender will consider you self-employed and request two years of business and personal tax returns.

If you own less than 25% of the business, the lender will see if ownership results in a business income or loss, and add or subtract it from your employment income.

Eligibility income: USDA loans come with income limits. The lender will factor in business ownership income, which may put you over income limits. If you have no ownership, this won’t affect you.

Pending job offer from a family business

You can’t use income from a job that has not started yet if it’s with a family business.

Normally, lenders let you use a job offer or employment contract if the income will start within 90 days of loan closing.

But conventional loan guidelines state that this isn’t allowed with a family-owned business.

Expect FHA, VA, and USDA lenders to fall in line with this rule. There’s just too much that can be manipulated with future employment by a family business.

Work for a family business? You can still qualify

While there are extra rules when you work for a family business, this is still eligible income for a mortgage.

Apply with a knowledgable lender to get your exact requirements and start the qualification process.