Many first-time and repeat buyers wonder if they can use a co-signer on an FHA multifamily duplex, triplex, or fourplex loan.

Unfortunately, you can not use a non-occupying co-signer or co-borrower on a 3.5% down FHA loan for a 2-4 unit property per HUD guidelines.

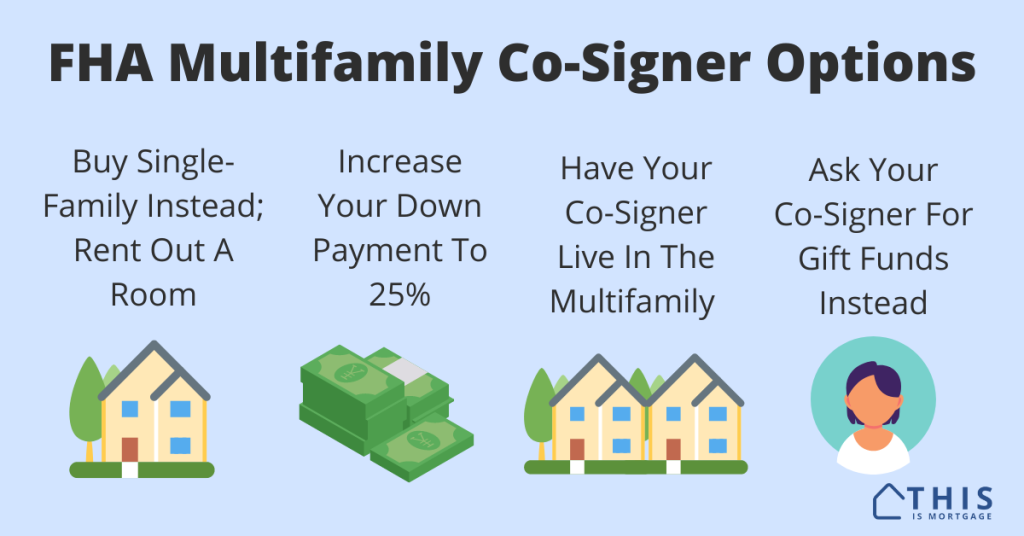

While this is disappointing news, here are some things you can do to either use a co-signer and/or still buy a multifamily property.

Speak to a loan officer to check your FHA eligibility when using a co-signer.

Buy a single-family residence and rent out a room

FHA allows a non-occupying co-borrower on a single-family residence with 3.5% down.

You can buy a single-family home and rent out a room if your main goal is to own a property and dabble in real estate investment. You can’t use that rental income to qualify for FHA, but it will help you afford the mortgage.

Even if a 1-unit home isn’t what you originally had in mind, it could be a good in-between solution if you need the non-occupying co-signer to buy a home.

Have the co-signer become an occupying co-borrower in the same or a different unit

When is a co-signer not a co-signer? When they plan to live in the property.

At that point, they become an occupying co-borrower.

With an occupying borrower, you can put 3.5% down on a 2-4 unit home.

Did you know that you can buy a house with anyone as long as they are not a party to the transaction? An occupying co-borrower does not have to be family.

Their status changes from a “non-occupying co-borrower” to a regular borrower the same as you. They are an equal party on the loan. The lender will consider their income toward the debt-to-income ratios.

They can live in the same unit as you. Or, they can live in an additional unit in the property.

Avoid fraud. Don’t falsely state that someone plans to move into the home with you when they have no intention of doing so. But if they can move in for 12 months or longer, feel free to call them an occupying co-borrower.

Check your FHA single-family or multifamily eligibility with a lender.

Put 25% down

Making a larger down payment may not be feasible, but worth mentioning. FHA does allow you to use a non-occupant co-signer by putting 25% down.

But if you’re going to put that much down, there could be better conventional options available. Or, the large down payment could bring the monthly payment down enough for you to qualify. In that case, you could obtain gift funds from your relative without them having to co-sign the loan.

Related: 5% Down Fannie Mae 2-4 Unit Loan

Ask for gift funds instead of co-signature

If all you need is down payment help, a family member or close friend can contribute your entire down payment and closing costs via gift funds.

This won’t help if you don’t have enough income to qualify. But it is the best option if you’re just short of cash to close.

If you have a generous co-signer, you could ask them to donate 25% down. This would enable you to use them as a co-signer on the loan. It could also reduce the loan amount enough so that you could qualify on your own with no co-signer.

Look into conventional

You can use a Fannie Mae loan for 5% down. However, you can’t use a co-signer for multi-family homes. The buyer would have to qualify on their own. Rental income alone won’t be enough to qualify to buy the home.

As with FHA, you could rent out a room on a single-family home after purchase to make extra income.

Start your conventional multifamily loan by speaking with a loan professional.

Tips for adding a co-signer

If you decide to add a co-signer to the loan, here are things to be aware of.

A co-signer can be almost any family member: Family includes parents, children, step-siblings and step-parents, uncles, aunts, domestic partners, and any type of in-law. The co-signer must either be a U.S. citizen or have their principal residence in the U.S.

The loan will show up on their credit report: When your parent or other co-signer applies for a mortgage, auto loan, or other credit, your loan and payment will show up on their credit report. It could be harder for them to be approved.

They are liable for the payment if you don’t pay: Many co-signers don’t understand that they are 100% responsible for the loan payment if you don’t pay, in the eyes of the lender.

A co-signer’s high credit score won’t help your low credit score: The lender will use the lowest of all borrower and co-signer credit scores for eligibility purposes. For instance, if you have a 450 credit score and your co-signer has 800, you won’t be eligible for a 3.5% down FHA loan (minimum 580 score).

Make a plan to remove the co-borrower: Remove them from the loan as soon as possible. This can only be done with a refinance. The best option is to wait until you have 20% equity, then refinance into a conventional loan. This helps you remove the co-signer and FHA mortgage insurance at the same time. You would need to qualify for the loan on your own.

Check your FHA multifamily eligibility

FHA is usually the best option when considering a multifamily property, due to its low down payment requirement.