When your mortgage lender asks for a letter of explanation for derogatory credit, they want to prove that your credit troubles are behind you and are not likely to happen again.

Knowing that, here are templates to write the perfect LOE for past derogatory items on your credit report.

See if you can be approved to buy a home.

>>Download the Word document here

>>Download the fillable PDF here

What do underwriters look for in my LOE for derogatory credit?

Mortgage underwriters look to the past to predict the future.

Applicants who show continuous disregard for financial obligations have a high chance of missing mortgage payments, or even entering foreclosure.

Underwriters want to prove that one of two things happened:

- You had a one-time, extraordinary event that caused missed payments, bankruptcy, or foreclosure, or;

- You were inexperienced with credit in the past, but now you have demonstrated financial responsibility

Either of these are acceptable, but the first scenario is better. It shows that you are generally good with finances, but an external shock outside your control caused derogatory credit.

Item 2 is harder to recover from. You should demonstrate 12 or more months of reasonable credit prior to applying for a loan. If you have recent late payments, the underwriter can’t build a case that you’ll make mortgage payments on time.

Check your home buying eligibility with a lender.

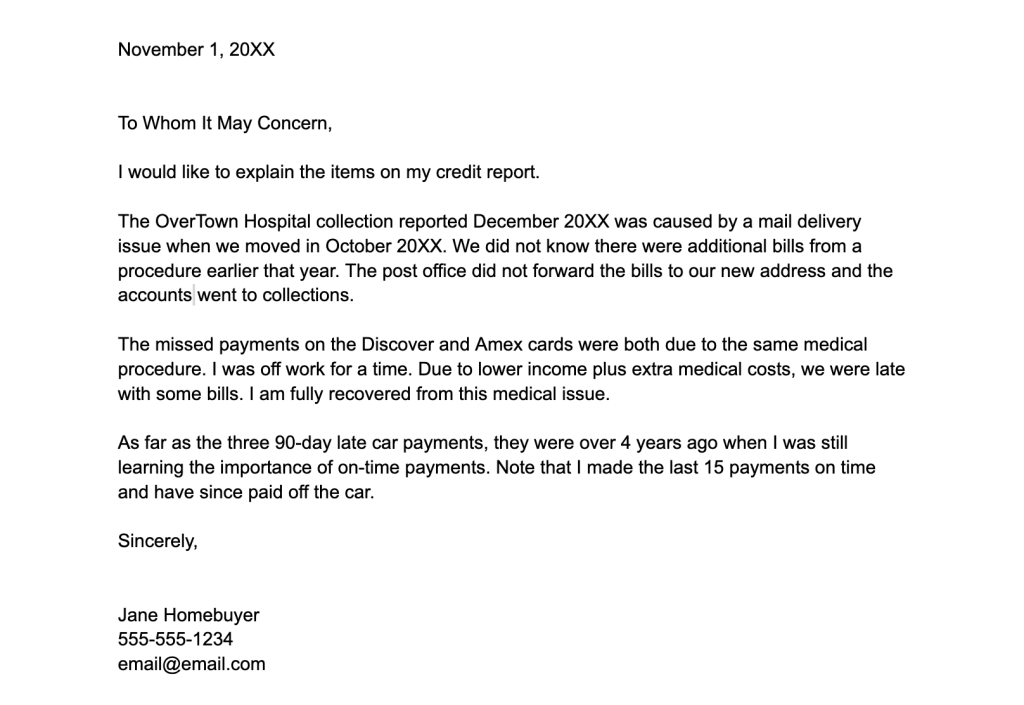

How to explain derogatory credit: one-time financial event

Paint a picture for the underwriter that you experienced a major financial event that was outside your control.

Some examples are a job loss due to downsizing, a medical emergency, a harsh divorce, or the death of a loved one. These types of events are easy to explain. They are rarely due to financial mismanagement.

It helps if you point out that you had great credit before the event, and have rebuilt your credit since.

Additionally, show that you are fully recovered from the events. Include the amount of time past since you’ve missed a payment and other proof that your financial circumstances are now stable.

Get a second opinion from an experienced lender if you’ve been denied.

How to explain derogatory credit: general credit mismanagement

You might not have experienced a specific event that caused missed payments, collections, and other derogatory credit. Rather, you may have been like many others and did not know how to handle credit responsibly.

This is a fine explanation. The key is to show that you have handled credit well since that period, hopefully for at least the past 12 months.

As a bonus, describe that you’ve been able to build up a savings and retirement account. This shows you are going above and beyond just keeping up with bills.

Recovering from mortgage-related derogatory items

You may have had serious late payments on a mortgage, or even a foreclosure, in your past. Fortunately, you can still buy a home.

The waiting periods for these events are longer than missing a few credit card or auto payments.

However, the same principles apply. Explain the circumstances around the late payments or foreclosure. Build your case that you are now ready to take on the responsibility of a new mortgage.

For more detail and a full list of waiting periods for major derogatory items, see:

Sample letter of explanation for derogatory credit for mortgage – FAQ

Explain why you had the late payments, collections, or other derogatory credit, then demonstrate how you have responsibly handled credit for at least the past 12 months.

Truthfully describe the whole situation around the event. Perhaps a medical bill was sent to the wrong address, creating a collection. Maybe the death of a loved one caused you to fall behind on bills. Detail how you have handled credit responsibly.

Explain the situation to the underwriter. Include documentation that you have reported the theft to the authorities and have done what you can to clear up the accounts.

Include the reason for the dispute and include documentation proving the payment was on time or that the creditor otherwise misreported the derogatory item. Beware that disputing accounts can jeopardize your mortgage approval.

Bad Credit in the past can be overcome

Just because you had bad credit at one point does not mean you can never again get a mortgage.

Underwriters get that life happens. The key is demonstrating restored your credit. This is a good indication you’ll make the mortgage payments on time.

You might be surprised how well a good letter of explanation helps you obtain a mortgage approval.