You might think that if you’ve had a foreclosure in the past, you are no longer eligible to buy another home.

That’s simply untrue.

Mortgage lenders can approve a loan after a foreclosure, deed-in-lieu, or short sale, given enough time since the event and rehabilitated credit.

Here’s how to buy a house after foreclosure.

Contact a lender to see if you can be approved.

- FHA foreclosure waiting period

- USDA foreclosure waiting period

- VA foreclosure waiting period

- Conventional loan foreclosure waiting period

- Non-QM foreclosure waiting periods

- Waiting period chart: Standard

- Waiting period chart: extenuating circumstance

- What is an extenuating circumstance?

- Foreclosure waiting period infographic

- When does the waiting period start?

- Help! I’m on the CAlVRS list!

- FAQ about buying a house after foreclosure

- Buying a house after foreclosure: totally possible

FHA foreclosure waiting period

You must wait 3 years after foreclosure and 3 years after a deed-in-lieu or short sale. If the event was caused by an extenuating circumstance like the death of a household wage earner or medical emergency, waiting periods are reduced to 1 year.

Start your new home loan with an FHA lender.

USDA foreclosure waiting period

You must wait 3 years after a foreclosure, deed-in-lieu, or short sale to buy again with a USDA loan. USDA does not reduce waiting periods for extenuating circumstances.

VA foreclosure waiting period

The waiting period to use a VA loan after foreclosure, deed-in-lieu, or short sale is 2 years, and 1 year if it was due to an extenuating circumstance.

Conventional loan foreclosure waiting period

You must wait 7 years from a foreclosure or 4 years from a deed-in-lieu or short sale to get a conventional loan. If caused by an extenuating circumstance, waiting periods are reduced to 3 years after foreclosure and 2 years after a deed-in-lieu or short sale.

Speak to a lender to check your eligibility for a conventional loan.

Non-QM foreclosure waiting periods

Some alternative or “Non-QM” lenders allow you to buy again immediately after a foreclosure or similar event.

Waiting period chart: Standard

| Loan type | Foreclosure | Deed-in-lieu/ Short sale |

|---|---|---|

| Conventional (Fannie Mae & Freddie Mac) | 7 years | 4 years |

| FHA | 3 years | 3 years |

| VA | 2 years | 2 years |

| USDA | 3 years | 3 years |

| Non-QM | 1 day | 1 day |

Waiting period chart: extenuating circumstance

| Loan Type | Foreclosure | Deed-in-lieu/ Short sale |

|---|---|---|

| Conventional (Fannie Mae & Freddie Mac) | 3 years | 2 years |

| FHA | 1 year | 1 year |

| VA | 1 year | 1 year |

| USDA | 3 years | 3 years |

| Non-QM | 1 day | 1 day |

What is an extenuating circumstance?

Even mortgage lenders understand that “life happens.” You have a major medical event, a primary wage-earner passes away, or you experience another financial event that was outside your control.

The lender is looking for events that weren’t a result of financial mismanagement. For instance, you were in a car wreck which caused income loss and mounting bills.

And even with a good reason, you may not be approved for shorter waiting periods.

For instance, FHA does not consider the following events “beyond your control”:

- Divorce

- Job loss

- Inability to sell a home

In all cases, expect to wait the full period. Each loan program has a different definition of “beyond your control” and “financial mismanagement.” It’s best to speak to an experienced lender and have your file fully underwritten to get a final answer.

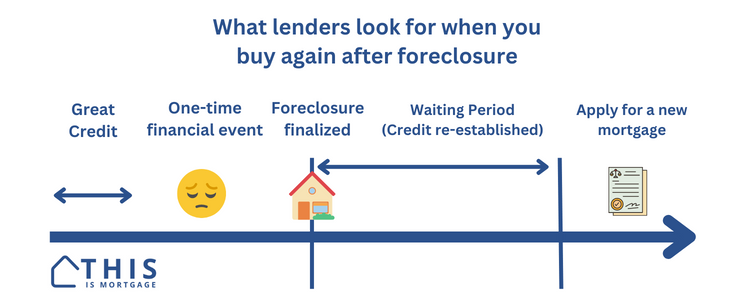

Foreclosure waiting period infographic

Whether you’re looking to qualify for shorter waiting periods or not, here’s what the lender is looking for when deciding to approve you after a foreclosure.

Contrary to popular belief, it’s not just a matter of waiting long enough after foreclosure, although that’s part of it.

It’s all about how you’ve managed credit after the foreclosure. You usually must have impeccable credit for three to seven years afterward, depending on the loan program.

Example approval scenario: You purchased a home when you were 22 before you knew how to budget or control spending. You went into foreclosure. You have since received new credit cards and an auto loan. You’ve made all payments on time, including rent, for seven years. You may be approved, despite early financial mismanagement.

When does the waiting period start?

The foreclosure waiting period starts when the home is “off the lender’s books.” This means one of the following:

- The home has been sold in a foreclosure sale and your name is removed from the deed

- The lender has received HUD’s insurance payment reimbursing them for the loan, if it was an FHA loan.

So, unfortunately, the waiting period does not start the day you move out. HUD could take time to make its payment to the lender. Or a lender of a non-FHA loan could sit on the home for months before selling it.

So it may “feel” like a four-year waiting period, even though an official guideline says three years.

Speak to a lender to see if you can be approved.

Help! I’m on the CAlVRS list!

The Credit Alert Verification Reporting System (CAlVRS) alerts the lender that you are in default on a federal debt, including a previous government-sponsored mortgage, student loan, or even SBA loan.

You are not eligible for an FHA, VA, or USDA loan if you’re on the list.

If your foreclosure was on a government-backed mortgage, there’s a three-year waiting period to be removed. The longer of the program’s waiting period or CAIVRS waiting period will apply.

To be removed from the list as soon as possible, pay the federal debt in full.

If there’s any doubt, make sure your lender pulls CAIVRS when you request a homebuying pre-approval.

Related:

FAQ about buying a house after foreclosure

Lenders define the start of the waiting period after foreclosure as 1) the date HUD issues the insurance payment to the former lender, if it was an FHA loan, or; 2) The date the home was sold at auction and your name was removed from the deed.

You usually have to wait 3-7 years after foreclosure to buy again, plus demonstrate re-established credit during that timeframe. There are rare but possible exceptions, like when a significant event occurred that was beyond your control, such as the primary wage-earner passing away or an unforeseen medical event.

A foreclosure stays on your credit report for seven years and it can’t be removed. It will automatically fall off your credit after seven years.

Forfeiting the home can come in a few forms, such as a pre-foreclosure, deed-in-lieu of foreclosure, or short sale. Fannie Mae and Freddie Mac offer reduced waiting periods for these events, typically 4 years, but 2 years with extenuating circumstances.

Buying a house after foreclosure: totally possible

Having a foreclosure in your past isn’t the end of the road. You can still enjoy the benefits of homeownership, if you can prove you deserve it.

Make all credit account payments on time, starting now. Apply for new credit. The longer you have perfect credit accounts, the better your chances of being approved someday.

If you’ve restored your credit already, and enough time has passed, try applying with a lender now. You might be surprised that you can buy again.

Check your eligibility to buy again.

Sources:

Fannie Mae Selling Guide

Freddie Mac Selling Guide

USDA Handbook

VA Handbook