Most major loan programs allow you to use gift funds from family to cover some or all of your down payment and closing costs when purchasing a home.

But you’ll need a solid gift letter as well as additional documentation from you and the gift donor.

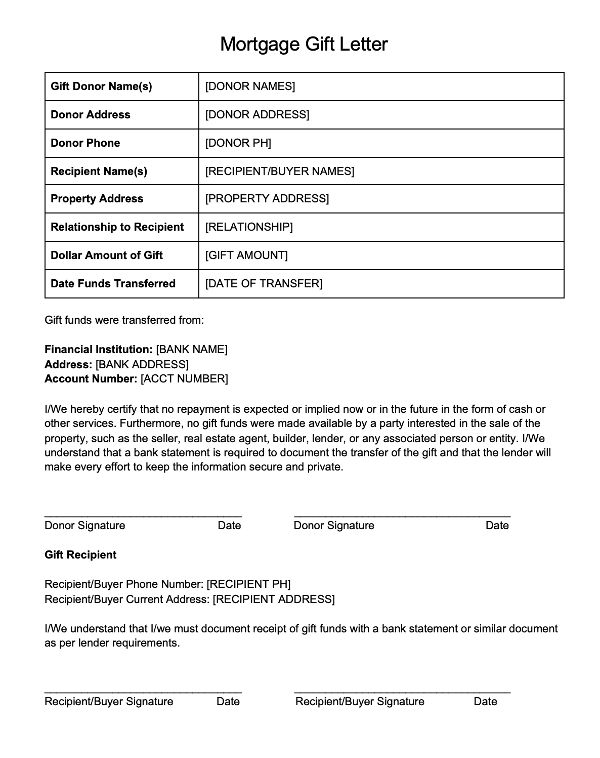

To start, here’s a template gift letter.

Submit your scenario to see if you can buy a home using gift funds.

Sample Gift Letter for Mortgage – Free Template Download

>>Download the fillable PDF here

>>Download the Word document here

Click the image to download the fillable PDF ↓↓

Gift Letter for Mortgage – FAQ

The lender needs to verify any money received is not a loan. A loan would increase your monthly debt payments and debt-to-income ratio, potentially pushing you over the limit.

Yes. All major programs require you to provide the donor’s bank statement showing the gift funds came out of their account.

Yes. You need to provide a bank statement or a confirmation from the escrow company showing funds were received.

No. A seller credit or credit from another party to the transaction is considered an interested party contribution. These are allowed up to certain limits. They can only be used toward closing costs, not the down payment. The only exception is when a family member is selling to another family member and offering a gift of equity in the home being sold.

Always check with a CPA before filing taxes, but typically, the homebuyer doesn’t pay taxes on any gifts received. The donor may need to pay taxes on gift amounts over $18,000 in 2024. The donor may be able to avoid paying taxes by giving two borrowers on the loan individual gifts of $18,000 each in 2024, for a total gift of $36,000. Check with your CPA before transferring any funds.

You’ll need a gift letter for any amount that would be considered a large deposit. That’s typically defined as 1% of the sales price for FHA, 50% of qualifying monthly income for conventional, and any deposit that seems irregular for USDA and VA loans.

Yes. A spouse who does not wish to be on the loan can give a cash gift to the loan applicant.

Who can give a mortgage gift?

| Loan Type | Who can give the gift? |

| Conventional | Any relative related by blood, marriage, adoption or legal guardianship, domestic partner, relative of domestic partner, former relative, godparent, fiancée or fiancé |

| FHA | Relative, employer, labor union, close friend with a documented interest in the borrower, charitable organization, a gov agency providing assistance to first-time and low-to-moderate income buyers |

| USDA | Anyone can give a gift except those who stand to benefit from the sale (i.e. an interested party like a realtor, lender, seller, builder, etc.) |

| VA | Anyone can give a gift except those who stand to benefit from the sale (i.e. an interested party like a realtor, lender, seller, builder, etc.) |

See if you can buy a home using gift funds. Speak to a lender here.

A word about donor privacy

Your donor is already being extremely helpful by offering a down payment gift. It’s often awkward to ask for their bank statement showing gift funds coming out. Unfortunately, this is an unavoidable lending rule.

Many donors have an issue with privacy, which is understandable. One reassurance is that lenders now use secure systems which are mandated and often audited by government agencies to ensure security of mortgage documentation. The above give letter attempts to reassure the donor that their information will be kept private and secure.

Yes, no system is foolproof, but much thought goes into data security at today’s lenders.

Bottom line: A gift letter is worth the effort

It’s often difficult to gather all the documentation needed to receive a mortgage gift. But the work is well worth it.

Homeownership is your final goal and the gift funds are allowing you to do it. Just a few weeks of homework and follow-up, and you could finally own a home.