When your mortgage lender reviews your loan application, it looks for current and previous address information.

Your credit report, bank statements, and other documents may show addresses that don’t match the rest of the file. Your lender will ask for a letter of explanation for any address discrepancy.

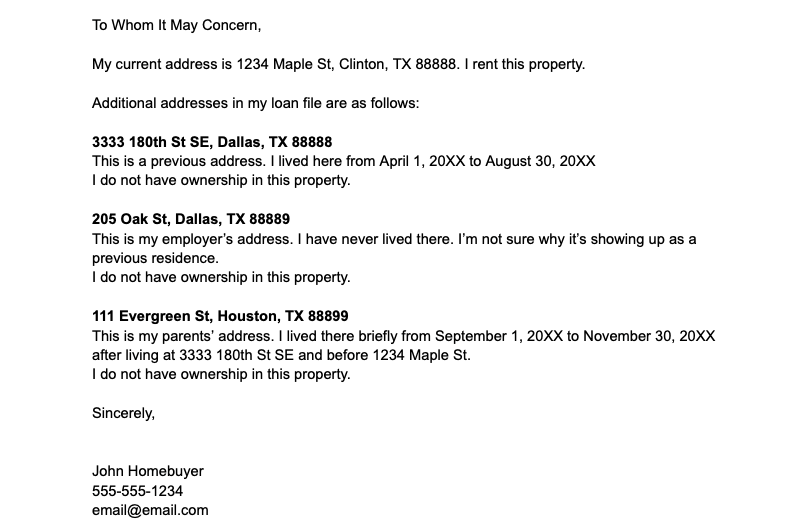

Downloadable sample mortgage letter of explanation for address

>>Download the Word document template here (edit and save as PDF)

>>Go to the Google Doc template here

Why does the lender need an address discrepancy letter?

There are a few reasons the lender may ask for an explanation for previous addresses.

Fraud

According to Fannie Mae, address inconsistencies could indicate fraud. For instance, someone may try to refinance a rental property as a primary home to get a better rate. The credit report shows their true primary residence address.

Property ownership

The lender wants to ensure that you do not own other properties. Undisclosed properties and mortgages could disqualify you from the new loan.

Underwriters are required to track down any discrepancy – address-related or otherwise – that they notice in the file.

See our library of mortgage explanation letters here.

Example credit report address history

Here’s an example of what the lender sees on your credit report. You can request a copy of your report from your lender.

| Address Reported: | Date Reported: |

| 123 Anystreet, Dallas, TX 88888 | 02/01/2018 |

| 555 Straight Street, Junction NY 11111 | 05/01/2020 |

| 433 Main Ave, Clinton, NJ 22222 | 08/01/2023 |

The addresses could raise questions if they don’t match your loan application. For example, you said you lived in Oregon in 2018 but your credit report says Texas. The underwriter may have to dig into the discrepancy.

Typically, address discrepancies are credit bureau errors. If you don’t recognize an address, simply explain that you don’t know why it’s showing up on your credit.

Sometimes a known address – a parent’s or employer’s address – will show up. State whose addresses they are and why they might be showing up. For instance, you lived with your parents for three months in between residences.

Other addresses found in your file

An alternate address may show up elsewhere besides your credit report.

- Bank statements

- Utility bills

- Pay stubs

- Insurance statements

For example, your pay stub or bank statement shows a former address. The underwriter will ask why. Perhaps you receive everything digitally and you forgot to update your physical address with your employer or bank.

Whatever the situation, be truthful. Make your best guess as to why that address is showing up.

Should you be worried about a letter of explanation for an address?

You shouldn’t lose sleep over this request. Typically, the address in question is an error or otherwise easily explained.

With a simple letter using the above template, the request will most likely be taken care of so you can move on with your loan approval.