A USDA loan requires no down payment, offers low mortgage rates, and is meant for less densely populated areas of the U.S. There’s even a construction loan available.

So financing a barndominium with a USDA loan seems like the perfect solution.

But it’s harder than it seems. That’s okay, because if you wanted to do things the easy, mainstream way, you wouldn’t be researching how to finance a barndominium.

Let’s find out how you can finance your very own “barndo” at potentially zero down payment.

Speak to a USDA lender about your barndominium purchase.

Appraisal comps: your biggest hurdle

All mortgages require the lender to prove the value of the property. Lenders need to make sure they can re-sell the home in case of foreclosure.

This is why unique homes are hard to finance. The lender knows there will be a limited number of buyers for a non-traditional home type.

However, there is an exception: if similar unique homes have sold in the area, the appraiser can establish a value and prove it could be sold if needed.

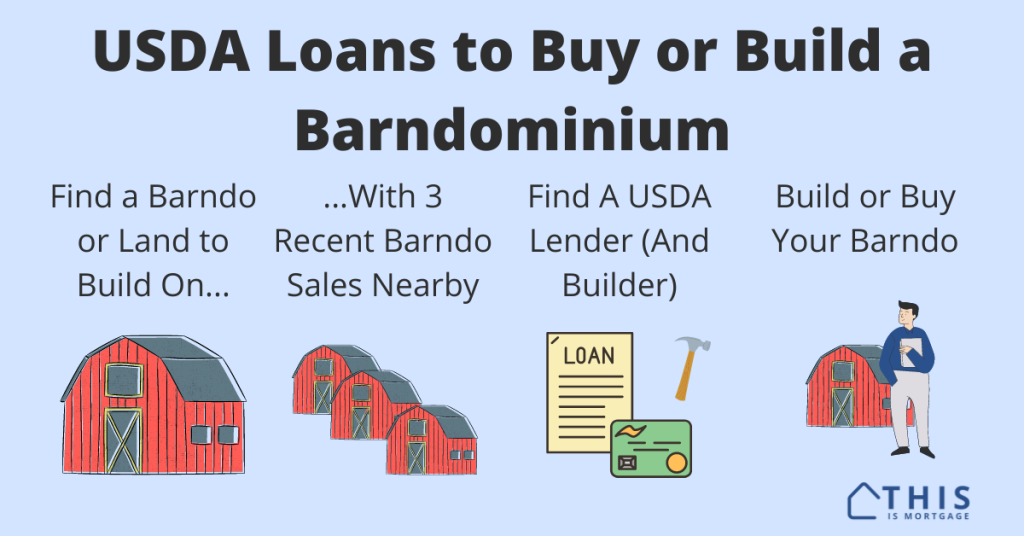

So your #1 task as you seek a USDA loan for a barndominium is to find a barndominium with three similar sales in the area within the past 6-12 months. These are known as comparable sales or “comps.” Past sales do not have to be financed with USDA. Even cash sales will work.

USDA doesn’t specify how close the comps have to be to the property. Preferably, they are within a few miles. In very remote areas, the appraiser could potentially find a comp 50 miles away, for instance, but it will depend on whether the appraiser thinks it’s similar to the one you’re buying.

The USDA manual states: “Not less than three comparable sales will be used unless the appraiser provides documentation that such comparable sales are not available.” In “areas lacking market activity,” appraisers can base value on something besides comparable sales, such as how much the home would cost to build. But few appraisers will do this and few lenders will accept such an appraisal. So your best bet is to find comps.

Luckily, USDA loans are specifically designed to promote homeownership in rural communities. Establishing value for remote and unique homes is nothing new for USDA lenders.

Start your USDA loan by getting pre-approved with a lender.

Financing a barndominium with standard USDA financing (non-construction)

If you’re looking to buy a pre-built barndominium, your job is a lot easier than building one from the ground up.

Once you find an existing barndo with adequate comparable sales, the rest of the process should be straightforward.

- Find a barndominium in a USDA-eligible area with adequate comps.

- Ensure that your income meets USDA income limits.

- Make sure you have adequate funds for USDA closing costs.

- Apply for a USDA loan with a bank or mortgage company that offers them.

- Submit your W2s, pay stubs, and bank statements. Allow the lender to pull your credit report.

- Get a pre-approval from the lender for as much or more than the barndominium price.

- Have the lender review the property you have in mind. Get their opinion on whether they can approve a USDA loan on it.

- Make an offer on the barndominium.

- Once you have an accepted offer, have the lender order the appraisal.

- Submit any missing documents and complete the loan approval.

- Sign final paperwork.

- Get the keys to your barndo.

USDA loans are lenient when it comes to credit scores (600 is typically required), and many applicants with lower incomes can qualify. And, the fact that they require zero down payment makes them more attractive than almost any other loan type.

Speak to a loan officer about your barndominium scenario.

Building a barndominium with a USDA construction loan

If you plan to build a barndominium from the ground up with a zero-down USDA loan, it’s a fantastic plan.

Zero-down construction loans are nearly non-existent, one of the few options coming from USDA.

These loans also have another advantage: you can use one loan to purchase the lot, build the home, and permanently finance the home. You don’t need a construction loan that you later have to refinance. It converts into long-term financing at the end of the construction period. That’s why USDA loans are known as single-close construction loans or construction-to-permanent loans.

These loans sound great. I want one!

Before you get too excited, let’s back up. While USDA construction loans are great in theory, actually getting one is more difficult, especially when building a non-traditional home like a barndominium. But that’s okay because you’re willing to do hard things to live a little differently than everyone else.

Consider buying an existing barndo, if you can. If not, your next step is to try a construction loan from USDA.

Here is the complex combination of requirements, all of which you’ll have to satisfy. You must:

- Find a USDA construction lender in your state.

- Build in an area that is both USDA-eligible and has had three barndominium sales in the past 6-12 months (to establish value for your new barndo).

- Find a barndominium builder that is willing to work with the USDA lender to submit plans, draw funds, and go through the extra steps required by USDA.

While not easy, lining up these three elements could make a barndominium USDA construction possible.

You’ll work with your builder to submit detailed, professional plans to the lender. The blueprint must comply with local building codes.

The lender will review the plans and order the appraisal. Keep in mind that the building cost plus land value must be less than your pre-approved mortgage amount.

I won’t detail all USDA construction loan requirements and processes here, because this would be a very long article. The best plan is to schedule a meeting with your builder and lender early in the process. They are the experts and can guide you through the steps, costs, and qualification standards.

Start your USDA construction loan. Speak to a lender here.

Finding a USDA barndominium lender

As mentioned, finding a USDA construction loan lender in your state could be difficult. Luckily, USDA keeps a running list of approved construction lenders. Keep in mind that these lenders may not finance barndominiums. Simply call each lender in your state and ask if they can consider unique home types.

Tip: A barndominium is a made-up word that the lender may not have even heard of. Don’t use that term. Just say you’d like to build a residential steel building as a primary residence.

| Lender | Location of Property | Ph |

|---|---|---|

| 1st Signature Lending | Alabama, Colorado, Florida, Georgia, Indiana, Kentucky, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, & West Virginia. In process: Arizona, California, Nevada, New Mexico, Oregon, Utah, & Washington. | (317) 893-3798 |

| Academy Mortgage | Washington | (509)680-1597 |

| AmeriFirst Financial Corp. | Florida, Indiana, Kentucky & Michigan | (850)926-4044 |

| American Financial Resources, Inc. | All states but Alaska & Hawaii | (800)316-9508 |

| American Security Mortgage Corp | North Carolina | (704)319-4624 |

| Atlantic Bay Mortgage Group | Delaware, Florida, Georgia, Indiana, Kentucky, Maryland, North Carolina, South Carolina, Tennessee, Texas, Virginia & West Virginia | (757)213-1660 |

| Assurance Financial Group, LLC | Louisiana | (225)448-2682 |

| Bankwest Inc. | South Dakota | (605)224-7391 |

| Click n’ Close Mortgage | All states but New York & Puerto Rico | (214)505-3361 |

| Evergreen Home Loans | Arizona, California, Idaho, Montana, Nevada, Oregon, Texas & Washington | (425)974-8500 |

| Flat Branch Mortgage Inc. | Arkansas, Illinois, Kansas, Missouri & Oklahoma | (314)872-0998 |

| GSF Mortgage Corp. d/b/a Go Mortgage | Alabama, Arkansas, Kansas, Louisiana, Michigan,North Carolina, Oregon, Washington & Wisconsin | (262)373-0790 |

| Lake Michigan Credit Union | Michigan | (844) 754-6280 |

| Metroplex Mortgage | Alabama, Florida, Tennessee & Texas | (813) 935-8330 |

| Multiples Mortgage Corp | Puerto Rico | (787) 296-3333 |

| NBT Bank | Select New York counties only | (607) 337-6167 |

| On Q Financial | Call for states – varies continually | (866)667-3279 |

| Stockton Mortgage Corp. | Kentucky | (502) 227-1100 x192 |

| Union Home Mortgage | Arizona, Arkansas, Florida, Georgia, Idaho, Illinois, Indiana, Kentucky, Louisiana, Michigan, Minnesota, Missouri, New Jersey, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia, West Virginia, & Wyoming | (440) 287-7311 |

| VIG Mortgage | Puerto Rico | (787) 200-8585 |

| Western Ohio Mortgage Corp. | Indiana, Kentucky, Ohio & Tennessee | (800) 736-8485 |

Participating Lenders – Construction-to-Permanent Loan Program Single Family Housing Guaranteed Loan Program FY 2022. Source: USDA

If none of these lenders can do a steel building, a.k.a. barndominium, call other steel building construction companies in your area.

They are likely the best source of ideas for financing. They may know of alternative lending sources such as:

- Local banks

- Credit unions

- National lenders

- Construction lenders

Non-USDA loans will likely require a down payment. But, if your heart is set on barndominium life, it’s a good idea to start building your down payment in case a USDA loan is not possible for your situation.

USDA loan for barndominium FAQ

USDA loans allow most property types as long as there are recent sales of similar homes in the area.

It’s possible to build a barndominium with a zero-down USDA construction loan. However, finding a lender to finance it could be challenging. See a list of USDA construction loan lenders here.

Yes, any property financed with a USDA loan must be within eligible USDA areas. Additionally, your income must be within published USDA limits and you must meet credit score, debt-to-income, and other requirements.

USDA loan for a barndominium: possible, but not easy

Living in a barndominium is a rewarding way of life. But it’s not mainstream for a reason. Alternative paths are usually harder.

But if you can figure it out, you’ll soon be looking out the front window of your barndominium to your chicken coup and vegetable garden, wondering why anyone would choose a regular home.

Get started on your USDA barndominium loan by speaking with a lender here.

Additional sources:

https://www.rd.usda.gov/sites/default/files/RD-SFH-AppraisalsNotes.pdf

https://www.rd.usda.gov/files/RD-RHS-SFHGSingleCloseLendersBuildersInfo.pdf

https://www.rd.usda.gov/files/3555-1chapter12.pdf

https://www.rd.usda.gov/sites/default/files/scc_participating_lenders_andinvestors_buying_scc_loans.pdf