If there’s one group of potential homebuyers that deserves down payment assistance, it’s teachers.

Educators have been historically underpaid, and often can’t afford to live in the communities they teach in – or any other community for that matter. Many can’t save up enough for upfront costs of homeownership like the 3-5% down payment plus another 2-5% for closing costs.

A new down payment assistance bill is being reviewed in Congress, and it could go a long way toward changing that.

See if you qualify to buy before the assistance is available. Start here.

- What is the Educator Down Payment Assistance Act?

- How much assistance would be available to teachers?

- Homebuying example

- Eligible Educators

- Other requirements to qualify for the proposed grant

- How the assistance could help teachers

- What is a first-time homebuyer, according to the Act?

- What’s the status of the bill?

- FAQ

- The $25,000 Educator Down Payment Assistance Act 2023: A Massive Benefit For Teacher-Homebuyers

What is the Educator Down Payment Assistance Act?

Fast facts

- It’s a grant currently being reviewed by Congress

- It would award $25,000 to teachers who are first-time homebuyers

- The grant could be combined with other down payment assistance programs for even more benefit

- It was introduced to the House of Representatives in mid-2022

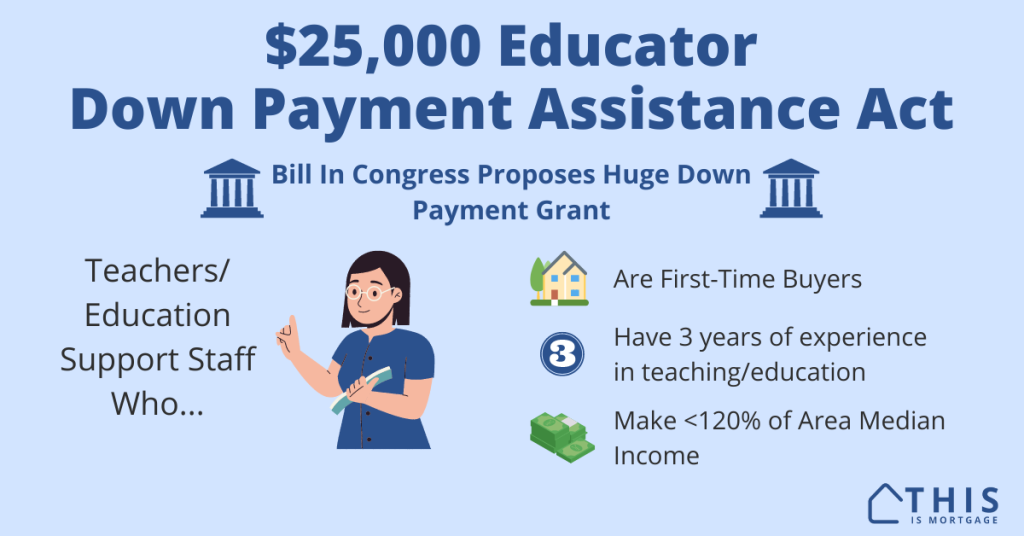

This Act is a potential $25,000 down payment assistance grant that could be available to teachers and education support staff soon.

It is currently being reviewed by the U.S. House of Representatives, still in its beginning stages. It is not yet signed into law, so not yet available. But it could be soon if it gains traction in Congress.

If passed, it would give public school educators a significant amount of assistance for a home down payment, closing costs, and rate buydowns, making homeownership more affordable.

This could be the help educators nationwide have been looking for to finally buy a home.

How much assistance would be available to teachers?

There is a proposed maximum grant of $25,000. However, teachers in high-cost areas are eligible for grants that “may exceed $25,000” according to the bill. A high-cost area would be determined by the area’s median income.

For instance, a teacher buying a home in a high-income area could receive $30,000, $35,000, or more, depending on the final rules established.

Homes are typically more expensive in high-income areas, which is why this provision could help. The additional grant funds could help many teachers live close to the schools they teach in, which is impossible for teachers in some school districts.

What’s more, though, is that the assistance could be combined with other grants and assistance. So a teacher could get the $25,000 Educator Down Payment Assistance grant, then get another $10,000 or more from a separate local grant program.

Check your eligibility for other homebuyer assistance programs.

Homebuying example

As an example, assume a teacher wants to buy a house for $400,000.

With an FHA loan, the down payment (3.5%) would be $14,000 and closing costs could add another $6,000, for a total of $20,000 cash needed to close. The teacher could use Educator Down Payment Assistance funds to cover the entire amount needed upfront, and use the extra $5,000 to buy down the rate, making monthly payments more affordable as well.

If the teacher received other down payment assistance, he or she could use it, too, as long as the other program allowed double assistance.

Eligible Educators

Though the title of the act denotes “Educators,” the assistance would be available to those in many other roles besides direct teaching positions.

- Public elementary or secondary school teacher

- Principals

- Paraprofessionals

- School leaders

- Other staff such as librarians, support personnel, counselors, aides, and administrative personnel

Currently, there is no provision in the bill to allow private school teachers to use it.

If you work in an above role, you would then need to

- Be a first-time homebuyer

- Have served in the educational system a minimum of 3 years, which do not have to be consecutive

- Currently be in good standing

- Make less than 120% of the area median income or 180% of the median income in high-cost areas, and qualify for the loan.

- Buy a house, condo, manufactured home, or 2-4 unit home

Other requirements to qualify for the proposed grant

Teachers must complete HUD-approved homeownership counseling program. These typically take just a few hours and may even be offered free of charge.

You must use an approved mortgage loan to purchase a first home, such as a Fannie Mae or Freddie Mac conventional loan, FHA, VA, or Section 184 Native American home loan.

You also must use the home as your primary residence for three years. If you vacate prior to that, you would have one year to pay back the assistance funds. If you stay the whole three years, the grant is forgiven and you never need to pay it back.

There are exceptions to the three-year rule for emergencies, such as military deployment, divorce, death of the eligible educator or spouse, or other approved unforeseen event.

Related: Empowered DPA Program for teachers, law enforcement, government workers, first responders, and more.

How the assistance could help teachers

Many teachers faithfully pay rent and could afford a mortgage. But due to high costs of living, a teacher’s salary doesn’t go a long way toward saving up a down payment of 3-5%.

This is especially true when a teacher’s school is located in a high-cost area.

Just one example of the hundreds of high-cost school districts in the U.S. is located in Washington State. The Lake Washington School District encompasses Redmond, Bellevue, and Kirkland, close to employers like Microsoft, Amazon, Starbucks, and more. The average home price in the district, according to Redfin, is over $1.6 million.

While the down payment grant would not likely help a teacher buy a home at this price, it could allow one to purchase a more affordable home within the district or at least get closer.

That could be an impossibility without a grant such as the $25,000 proposed by this bill.

But the teacher doesn’t have to be in an expensive area to use it.

Any teacher or educational staff as defined by the bill could use it to purchase a home in their area. And they could even combine it with other programs to qualify.

In other words, if you find a separate $20,000 assistance grant, you could get $45,000 total when combined with this bill.

What better way to support teachers than allowing them to start building wealth through real estate in their own community?

What is a first-time homebuyer, according to the Act?

The Act defines a first-time homebuyer as someone who has not had ownership in a home in the past three years.

It gives an exception for displaced homemakers and single parent who had owned a home with a former spouse but no longer lives there.

Someone who owned a mobile home or other structure that was not fixed to a permanent foundation is eligible, too.

What’s the status of the bill?

Officially called H.R. 8340 – Educator Down Payment Assistance Act of 2022, it was introduced into the U.S. House of Representatives on July 12, 2022, sponsored by Rep. Eric Stalwell of California and co-sponsored by Rep. Jahana Hayes of Connecticut. It was reviewed by the House Committee on Financial Services.

Here’s where the bill stands:

- The bill was created and sponsored – DONE

- Studied by a Committee – DONE

- Introduced to the House – DONE

- House Vote – Incomplete

- Amended (if necessary) – Incomplete

- Passed by House – Incomplete

- Reviewed and Passed by Senate – Incomplete

- Signed into Law by the President – Incomplete

Because bills like this are unpredictable, it’s difficult to determine when, or if, it will be signed into law. We will keep this article updated with developments.

FAQ

It’s difficult to predict when the Educator Down Payment Assistance Act assistance will be available since it must pass the House and Senate, and be signed into law. There could also be changes to the final version. We will update this article with developments.

The federal government will issue funds to state and local housing agencies or local education agencies to then deliver funds to teachers. If the bill is passed, local agencies will receive the funds, take applications, and deliver the funds to eligible teachers.

Eligible teachers will receive funds “at the closing table,” meaning the government agency will wire funds to your closing agent at the end of the transaction. The funds will reduce your cash needed to close. For instance, if your down payment and closing costs were $25,650, and the grant were $25,000, you would only need $650 of your own money to close the loan.

Yes. You can buy a single-family home, duplex, triplex, fourplex, condo, or manufactured home that is permanently affixed to a foundation.

Yes. You just need three years as an educator which does not have to be consecutive.

No, it must get voted on and be passed by the House of Representatives and Senate, then signed into law by President Biden.

No, you would need to use the grant at time of purchase, according to the current version of the bill. Because the bill is still being reviewed in Congress, you would have to wait to see if and when it becomes law, then apply. There’s no ETA for the program and it may not be signed into law at all. For many homebuyers, it could make sense to buy now instead of waiting.

You would be able to use down payment assistance funds toward a Fannie Mae or Freddie Mae conventional loan, FHA, VA or Section 184 Native American home loan. Any loan that meets Qualified Mortgage standards set by the Truth In Lending Act is eligible.

The $25,000 Educator Down Payment Assistance Act 2023: A Massive Benefit For Teacher-Homebuyers

There are few opportunities that come along that would be so beneficial for teachers who are first-time buyers.

If the bill gets traction in Congress, there could be millions of teachers suddenly eligible to buy a home.

See if you qualify to buy before the assistance is available. Start here.