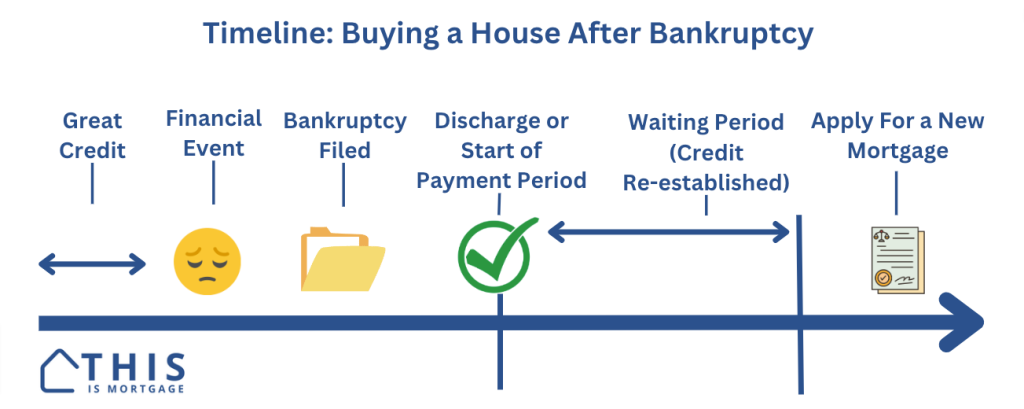

Buying a house after bankruptcy is completely possible if you’ve re-established your credit since the event. In some cases, you can apply for a mortgage in as little as one year after the discharge or repayment start date.

Here’s how to become a homeowner again.

Speak to a lender to see if you’re eligible to buy again.

In this article:

- Summary table: Waiting periods

- Conventional bankruptcy waiting periods

- FHA bankruptcy waiting periods

- VA bankruptcy waiting periods

- USDA bankruptcy waiting periods

- Non-QM bankruptcy waiting periods

- What is an extenuating circumstance?

- Infographic: Best case scenario after bankruptcy

- FAQ

Summary table: Buying a house after bankruptcy

| Summary: Waiting periods after bankruptcy | Chapter 7 | Chapter 11 | Chapter 13 |

| Conventional Standard (Fannie Mae & Freddie Mac) | 4 years | 4 years | 2 years |

| Conventional w/ extenuating circumstances (Fannie Mae & Freddie Mac) | 2 years | 2 years | 2 years |

| FHA Standard | 2 years | 1 year | 1 year |

| FHA w/ extenuating circumstances | 1 year | 1 year | 1 year |

| VA Standard | 2 years | 2 years | 1 year |

| VA w/ extenuating circumstances | 2 years | 2 years | 1 year |

| USDA Standard | 3 years | 1 year | 1 year |

| USDA w/ extenuating circumstances | 1-3 years | 1 year | 1 year |

| Non-QM | 1 day | 1 day | 1 day |

Now let’s dive into more specifics for each loan type.

Fannie Mae / Freddie Mac conventional loan bankruptcy waiting periods

| Fannie Mae/Freddie Mac Waiting Periods | Standard | Extenuating Circumstances |

| Chapter 7 Bankruptcy | 4 years from discharge or dismissal 5 yrs if >1 BK in last 7 yrs | 2 years from discharge or dismissal 3 yrs if >1 BK in last 7 yrs |

| Chapter 11 Bankruptcy | 4 years from discharge or dismissal 5 yrs if >1 BK in last 7 yrs | 2 years from discharge or dismissal 3 yrs if >1 BK in last 7 yrs |

| Chapter 13 Bankruptcy | 2 years from discharge 4 years from dismissal 5 yrs if >1 BK in last 7 yrs | 2 years from discharge or dismissal 3 yrs if >1 BK in last 7 yrs |

If you’re looking to buy a home after bankruptcy with a conventional loan, it’s important to determine what type of bankruptcy it was and whether it was discharged or dismissed.

For Chapter 7 or 11, you’ll need to wait four years from the discharge or dismissal date. With extenuating circumstances, you may be eligible in two years.

Chapter 13 bankruptcies only require two years from discharge since the lender can assume that it took some time to complete the payment plan. A dismissal means the bankruptcy was never completed. No additional time passed for the payment period, hence the longer waiting period for a dismissal.

Multiple bankruptcies within the last seven years will require longer-than-standard waiting periods.

Connect with a lender to check your conventional loan eligibility.

FHA loan bankruptcy waiting periods

| FHA Waiting Periods | Standard | Extenuating Circumstances |

| Chapter 7 Bankruptcy | 2 years from discharge if re-established credit or no new credit | 1 year from discharge with demonstrated ability to manage finances |

| Chapter 11 Bankruptcy | 1 yr from start of payment period w/permission from trustee | 1 yr from start of payment period w/permission from trustee |

| Chapter 13 Bankruptcy | 1 yr from start of payment period w/permission from trustee | 1 yr from start of payment period w/permission from trustee |

You can buy a home again two years after a discharged bankruptcy with a FHA loan. That waiting period drops to just one year for those with a documented extenuating circumstance (more on what that is later).

A Chapter 11 or 13 bankruptcy does not need to be discharged. If you’ve completed 12 full on-time payments in your repayment plan, you can apply for an FHA loan.

Keep in mind that with Chapter 11 and 13 bankruptcies, you’ll need permission from the court to enter into the mortgage. Make sure your trustee will grant permission before applying.

VA loan bankruptcy waiting periods

| VA Waiting Periods | Standard | Extenuating Circumstances |

| Chapter 7 Bankruptcy | 2 years from discharge date | 2 yrs from discharge; 1 yr from start of payment period is unlikely, but possible w/perfect payments and permission from trustee |

| Chapter 11 Bankruptcy | 1 yr from start of payment period w/perfect payments and permission from trustee | 1 yr from start of payment period w/perfect payments and permission from trustee |

| Chapter 13 Bankruptcy | 1 yr from start of payment period w/perfect payments and permission from trustee | 1 yr from start of payment period w/perfect payments and permission from trustee |

VA is one of the more lenient programs when it comes to buying a house after bankruptcy. A bankruptcy discharged more than two years ago can be ignored, according to VA guidelines.

A Chapter 13 bankruptcy where the payment period is complete can also be ignored. If the payment period is not complete, you can apply for a VA loan after 12 months of on-time bankruptcy payments with permission from the court.

USDA loan bankruptcy waiting periods

| USDA Waiting Periods | Standard | Extenuating Circumstances |

| Chapter 7 Bankruptcy | 3 years from discharge; Automated underwriting system may issue an approval less than 3 years from discharge | 3 years from discharge; Automated underwriting system may issue an approval less than 3 years from discharge |

| Chapter 11 Bankruptcy | 1 year from start of payment period with automated underwriting approval and permission from trustee | 1 year from start of payment period with automated underwriting approval and permission from trustee |

| Chapter 13 Bankruptcy | 1 year from start of payment period with automated underwriting approval and permission from trustee | 1 year from start of payment period with automated underwriting approval and permission from trustee |

USDA does not consider a bankruptcy discharged more than three years ago as adverse credit. The lender can completely ignore it.

USDA does not publish specific timeframes for exceptions. Instead, its automated underwriting system can issue an approval prior to the three-year mark if the file is strong.

Compensating factors that may help you get approved for a USDA loan after bankruptcy include a good credit score, zero late payments on new debt since the bankruptcy, on-time rent payments, substantial cash reserves, and making a down payment, even though one isn’t required.

Check your USDA eligibility with a lender.

Non-QM loan bankruptcy waiting periods

| Non-QM Waiting Periods | Standard | Extenuating Circumstances |

| Chapter 7 Bankruptcy | 1 day. Eligibility standards vary. | 1 day. Eligibility standards vary. |

| Chapter 11 Bankruptcy | 1 day. Eligibility standards vary. | 1 day. Eligibility standards vary. |

| Chapter 13 Bankruptcy | 1 day. Eligibility standards vary. | 1 day. Eligibility standards vary. |

Non-QM loans are not regulated in the same way as conventional and government loans. Lenders can make their own rules and decisions.

This flexibility allows them to approve an applicant as little as one day after bankruptcy or even foreclosure.

But there is a catch: you’ll probably need a large down payment and will pay higher rates. But if your goal is to just get into a home as quickly as possible, a non-QM loan could help. And, you can always refinance into another loan type when you meet time periods detailed above.

Lenders can add extra rules

The above guidelines are straight out of the rulebooks. But that doesn’t mean every lender adheres to published rules.

While they will never be less strict, they will often add restrictions when issuing these loans.

This is because each agency gives lenders permission to add “overlays,” which are higher standards than the agencies maintain.

The good news is, though, that you can keep shopping for a lender that underwrites “by the book.” Find another lender if you meet agency guidelines but are still denied.

Related:

What is an extenuating circumstance?

An extenuating circumstance is an event that is beyond your control that ruined your finances.

Some examples are

- Prolonged strikes

- Medical bills

- Death of a primary wage earner

The lender is looking for events that weren’t a result of financial mismanagement. For instance, if you were in a car wreck which caused income loss and mounting bills.

And even with a good reason, you may not be approved for shorter waiting periods.

For instance, FHA does not consider the following events “beyond your control”:

- Divorce

- Job loss

- Inability to sell a home

In all cases, expect to wait the full period. Each loan program has a different definition of “beyond your control” and “financial mismanagement.” It’s best to speak to an experienced lender and have your file fully underwritten to get a final answer.

Speak to a lender to see if you’re eligible to buy again.

How to be approved after bankruptcy: infographic

Whether you’re looking to qualify for shorter waiting periods or not, here’s what the lender is looking for when deciding to approve you after bankruptcy.

The less-than-ideal scenario, but still acceptable

It’s not just a matter of waiting long enough after a bankruptcy.

The lender scrutinizes how you managed credit and bankruptcy payments afterward. Just one late payment after bankruptcy can derail your mortgage approval.

Example approval scenario: You purchased a home when you were 22 before you knew how to budget or control spending. You filed for bankruptcy. You made an effort to repay creditors and have made all payments on time. You have since received new credit cards and an auto loan. You may be approved, despite early financial mismanagement.

When does the waiting period start and end?

- Fannie Mae/Freddie Mac: Discharge or dismissal

- FHA: Measured from the discharge date or start of payment period, depending on bankruptcy type

- VA: Discharge date or payment start date depending on bankruptcy type

- USDA: Discharge or start of payment date depending on bankruptcy type

The end of the waiting period always refers to the application date, not when you can close on the home. You can’t apply prior to the end of the waiting period so that you can close the day after.

Help! I’m on the CAlVRS list!

The Credit Alert Verification Reporting System (CAlVRS) alerts the lender that you are in default on a federal debt, including a previous government-sponsored mortgage, student loan, or SBA loan.

You are not eligible for an FHA, VA, or USDA loan if you’re on the list.

If your bankruptcy resulted in a foreclosure or default on a government-backed loan, there’s a good chance you are on the list. If so, you are ineligible for a new government loan for three years.

To be removed from the list as soon as possible, pay the federal debt in full.

Make sure your lender pulls CAIVRS when you request a homebuying pre-approval.

Related: Buying a house after foreclosure

Some wonder about foreclosure waiting periods. In general, they are longer than for bankruptcy.

This makes sense: a foreclosure means history of housing debt non-payment, the same kind of debt you’re seeking with a mortgage.

Bankruptcy is essentially default on other types of debts, not necessarily mortgages.

If you’ve had a foreclosure, see: Buying a House After Foreclosure: FHA, Conventional, VA, USDA, Non-QM

FAQ

You are not legally required to repay the mortgage debt, so it won’t factor into your debt ratios. However, if the home’s title is still in your name, the lender may include taxes, insurance, and HOA dues into your debt-to-income. Additionally, you may be on the CAlVERS list if you defaulted on a federal debt, making you ineligible for a new government-backed loan.

You can apply in as little as 1 year after the Chapter 7 discharge date with an FHA loan. The bankruptcy must have been caused by circumstances outside your control and not due to financial mismanagement. And, you need to demonstrate rehabilitated credit. Some lenders will impose a 2-year waiting period.

Yes. While you won’t be able to use your spouse’s income for qualification, you can apply under your name only. If you are the primary wage earner, this is a good solution. You can use joint accounts for the down payment and closing costs, or your spouse can gift you the money.

If you want to purchase a home in the next 2 to 4 years, you should avoid bankruptcy if possible. However, for some people it’s a good way to “start over.” Don’t file for bankruptcy unless you have addressed issues that led you to this point, or it was due to a one-time event that is not likely to recur. It’s a big decision that could affect you for 7-10 years so consult an attorney and financial planner.

Many ways to buy a home after bankruptcy

No one is perfect, and even the most prepared individuals must file bankruptcy when life deals them a blow.

Fortunately, there are ways to own a home again after bankruptcy with some work and perseverance.

Speak to a lender to see if you’re eligible to buy a home again.

Sources:

Fannie Mae Selling Guide

Freddie Mac Selling Guide

USDA Handbook

VA Handbook