If you have been off work for longer than a month in the past two years, a mortgage lender may ask for a letter explaining the gap in employment.

This is not something to be worried about. It’s simply the lender complying with lending rules so it can close your loan.

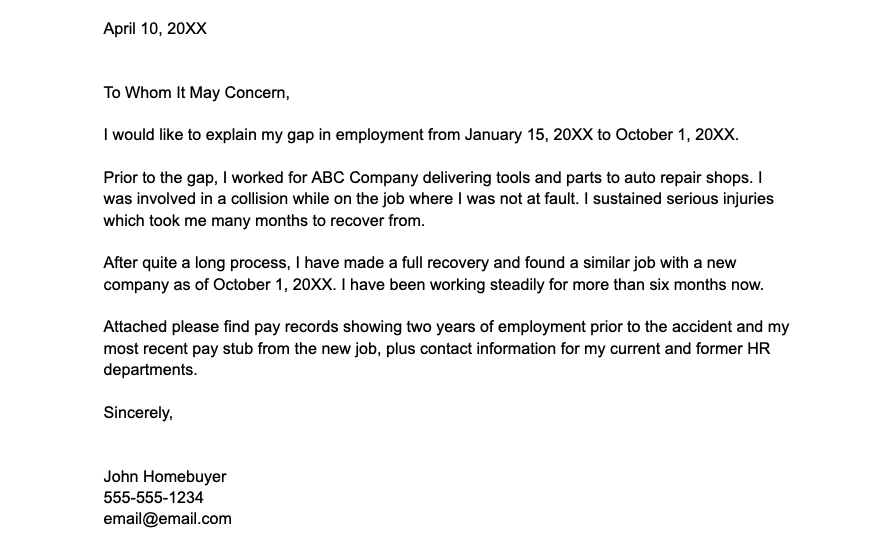

Here is a sample mortgage letter of explanation (LOE or LOX) for your gap in employment.

- Sample letter explaining gap in employment for mortgage loan – template download

- What is the lender looking for in my employment gap LOE?

- Conventional loan employment gap rules

- FHA loans and employment gaps

- USDA loans

- VA loans

- Returning to self-employment, part-time, or variable income

- Employment gaps for school, training, or military service

- Returning to seasonal work

- Returning to a second job

- Employment gap letter of explanation FAQ

- Employment gap LOEs are just part of the process

Sample letter explaining gap in employment for mortgage loan – template download

>>Download the Word document here

>>Download the PDF here (requires PDF editor to edit)

What is the lender looking for in my employment gap LOE?

The lender is looking to build their case that you will stay employed for the foreseeable future.

Your letter should indicate that your employment gap was a one-time event that is not likely to re-occur.

For example, you took a year off to be a stay-at-home parent. But now, the kids are in school so you are returning to work.

Submit your homebuying scenario.

Conventional loan employment gap rules

Gaps less than 6 months: You need an employment offer letter and your first pay stub.

Gaps more than 6 months: You need to be back at work for 6 months to qualify.

Freddie Mac, the other major conventional loan agency, states that it does not require a letter of explanation for a gap, but the lender is permitted to request one.

Both agencies require proof of stable employment before the gap. This might be completed with a verification of employment from the previous employer or other documentation proving a two-year employment history prior to taking time off.

Check your conventional loan eligibility with a lender.

FHA loans and employment gaps

Gaps less than 6 months: FHA guidelines don’t specifically address this scenario, but presumably, you need to be back to work and provide at least one paystub.

Gaps longer than 6 months: You must provide a letter of explanation and be back to work for at least six months.

The lender must verify two years of work history prior to the employment gap. Have your former employer’s HR department contact information available.

USDA loans

USDA is the toughest of all when it comes to employment gaps. Gaps longer than 30 days require a letter of explanation unless the employment is clearly seasonal. You need 12 months of employment history after a gap longer than 30 days. Additionally, school or training does not count toward your employment history as it does with other loan types.

See if you qualify for USDA. Connect with a lender here.

VA loans

No explanation letter is required for gaps less than 60 days if you receive an “approved” recommendation from VA’s computerized system (the lender runs this for you). Gaps longer than 60 days other than for school, training, or military service must be explained. Depending on the lender, you may need anywhere from 30 days to 12 months back on the job based on the length of the gap.

Returning to self-employment, part-time, or variable income

Generally, you need to be re-entering full-time, salaried employment after a job gap. The lender may not be able to use your income for qualifying purposes when returning to a part-time or self-employed position.

Likewise, commission, overtime, and bonus income won’t be counted toward qualification until you establish a new two-year work history.

Employment gaps for school, training, or military service

These types of gaps are typically acceptable. They may not need an explanation letter and may count toward employment history.

The exception is USDA loans. USDA no longer considers school as part of your employment history. You still must have one year of actual work history after schooling to qualify.

Returning to seasonal work

Lenders will consider seasonal work that you are returning to when there’s a pattern for the past two years.

For example, you work the holiday season at a package delivery service from October to January each year. You may be approved before the current year’s season. It does help your case if you’ve returned and can show a pay stub.

Returning to a second job

Generally, the lender won’t consider income from a second job until you’ve had two years’ history working two jobs simultaneously. Even a small gap will likely disqualify any secondary employment income.

Employment gap letter of explanation FAQ

You can have any gap of employment, but you must re-establish various lengths of work history for each loan type. For conventional, you must have six months of employment after a six-month gap. For FHA, you also need to be back to work for six months. USDA loans require a 12-month history after a gap longer than 30 days. VA loans may require from 30 days to 12 months of re-established work history to qualify, depending on the lender. You may need just an offer letter from your new employer and your first pay stub for shorter work gaps.

Lenders must make a case that your income will continue for the next three years. The best indicator of future income is how you have held down a job in the past. Someone with regular employment gaps for no apparent reason will likely have employment gaps in the future, potentially causing loan repayment problems.

Lenders want to see that the employment gap was a one-time event for a logical reason, and that it is not likely to re-occur. They also need to see documentation of solid employment before the absence and that you are back to work in a similar career field.

Employment gap LOEs are just part of the process

Don’t hate your lender for asking for a letter of explanation. They are simply trying to fulfill their requirements and get the loan closed.

Providing the letter, plus documentation, will get your loan closed fast so you can move on to other things.