One of the most common requests from a mortgage applicant is to explain a “large deposit” on a bank statement.

The lender needs to make sure that all funds came from an eligible source. If your lender asks for a letter of explanation (LOE or LOX) for a large deposit, here are free downloadable templates to get you started.

See if you can get better rates and fees. Connect with a lender.

Sample letter of explanation for large deposit – template download

>>Download the Word document here

>>Download the PDF here (requires PDF editor to edit)

When does the lender need a large deposit letter?

The large deposit LOE requirement will depend on what type of loan you’re getting.

Conventional (Fannie Mae or Freddie Mac): Any single deposit of more than 50% of the total monthly qualifying income for the loan must be explained. For instance, if you and your spouse make a total of $8,000 per month, any deposits over $4,000 must be documented.

FHA: Deposits of more than 1% of the sales price must be explained and documented. For instance, you’re buying a home for $250,000 so you must document any deposit greater than $2,500.

USDA loans: USDA requires the lender to document “any large deposit or increase in account balance.” So it’s largely up to the lender’s judgment about how much constitutes a large deposit in your case.

VA loans: Each lender will decide whether a bank deposit requires explanation or documentation based on the income, assets, and other factors of the loan file.

Don’t be surprised, though, if a lender asks you to explain deposits below thresholds. They have to right to verify anything that looks out of place.

For any loan program, the lender generally won’t ask for an explanation for a deposit with an obvious source listed on the bank statement, such as a bonus from your employer, a tax refund direct-deposited by the IRS, or a social security payment.

Get a second opinion on rates and fees by requesting a call here.

Why does a lender need an LOE for a large deposit?

No matter what type of loan you’re getting, the lender needs to know that the deposited funds didn’t come from a loan. This would increase your debt-to-income ratio, potentially disqualifying you from the mortgage.

The lender also needs to verify that the cash is not from anyone who has an interest in closing the transaction like a Realtor, builder, seller, or loan officer. Such funds from interested parties must fall within guidelines.

Lastly, each loan type has a minimum amount you must contribute from your own funds. Some programs allow you to count gifts from family or a down payment assistance funds as personal assets.

Either way, the lender has to verify that you meet minimum investment requirements.

A gift from a relative is typically okay for most programs. But that will trigger a gift letter and documentation of the funds transfer.

When you need additional documentation

Depending on the source of the large deposit, you will likely need some kind of proof to back up the explanation letter.

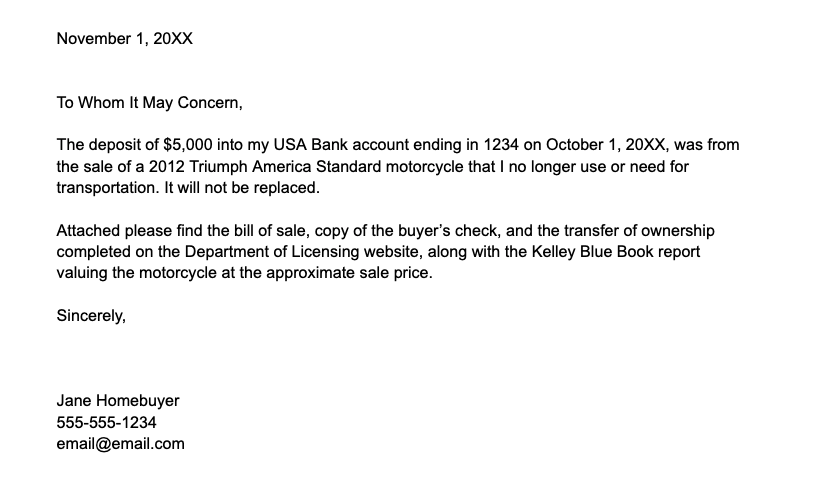

For instance, you sold a motorcycle that you no longer use. You received a personal check for $5,000. Along with the letter, provide the bill of sale signed by the buyer, a copy of the check, online transfer of ownership completed on the state’s website, and even the Craigslist ad.

Other examples of supporting documentation are:

- A wedding invitation if you received multiple cash gifts from a wedding

- A letter from a friend saying he borrowed money and paid you back

- Copy of a check you received from a side project

Think of any documentation that could help prove the source of funds and supply it when asked for the letter.

Documentation needed for virtual currency large deposit

Virtual currency is acceptable as a down payment source, says Fannie Mae. It must be converted to U.S. dollars and deposited to a regular bank.

Additionally, you’ll have to print a history of ownership. Hopefully, the organization that held the currency can provide such a history. Usually, you only need to prove about 60 days of history of owning the currency.

Start your home purchase or refinance by finding a lender here.

What if no documentation is available?

In some cases, the lender may be able to deduct the undocumented large deposit from your total assets. For instance, you have $50,000 in savings. You need $30,000 for down payment, closing costs, and reserves. If you have a $5,000 deposit, the lender may be able to reduce your qualifying available cash to $45,000 instead of requiring documentation.

FAQ

No. Unless advised by your loan officer, wait for the underwriter to ask for a letter of explanation. The underwriter may not need a letter. Underwriters must dig into any situation they encounter in the file and a letter may trigger more questions.

For a conventional loan, it’s 50% or more of the monthly qualifying income. For FHA, it’s 1% of the sales price. For VA and USDA loans, the underwriter requests large deposit letters on a case-by-case basis.

Detail where the deposit came from, preferably showing that the deposit was not a loan. Mention and attach documentation proving your statement, such as a bill of sale for a sold vehicle. Download a template here.

Don’t be afraid to write a letter of explanation for a large deposit

The underwriter doesn’t have anything against you. He or she is trying to get your loan completed just like you are. But, the underwriter is responsible to meet all lending guidelines.

Simply explain the deposit with the truth, and be open to follow-up questions or documentation requests.

Typically, one letter does wonders to clear up questions about a large deposit.

See if you can get better rates and fees. Connect with a lender.