One of the best investment opportunities in today’s market is the FHA multifamily loan.

With it, you can buy a primary home and an investment property in one, with just 3.5% down and a credit score as low as 580.

FHA’s mission is to encourage homeownership, and that includes a duplex, triplex, or fourplex where you live in one unit and rent out the rest.

But do all lenders offer this loan type? Let’s find out.

Connect with a knowledgeable FHA multifamily lender here.

In this article:

- Top 10 FHA multifamily lenders

- Are these the best lenders?

- What to look for in a multifamily lender

- Where to find a multifamily lender

- Shopping for the best rates

- How to choose wisely

Top 10 FHA Multifamily Lenders in the U.S.

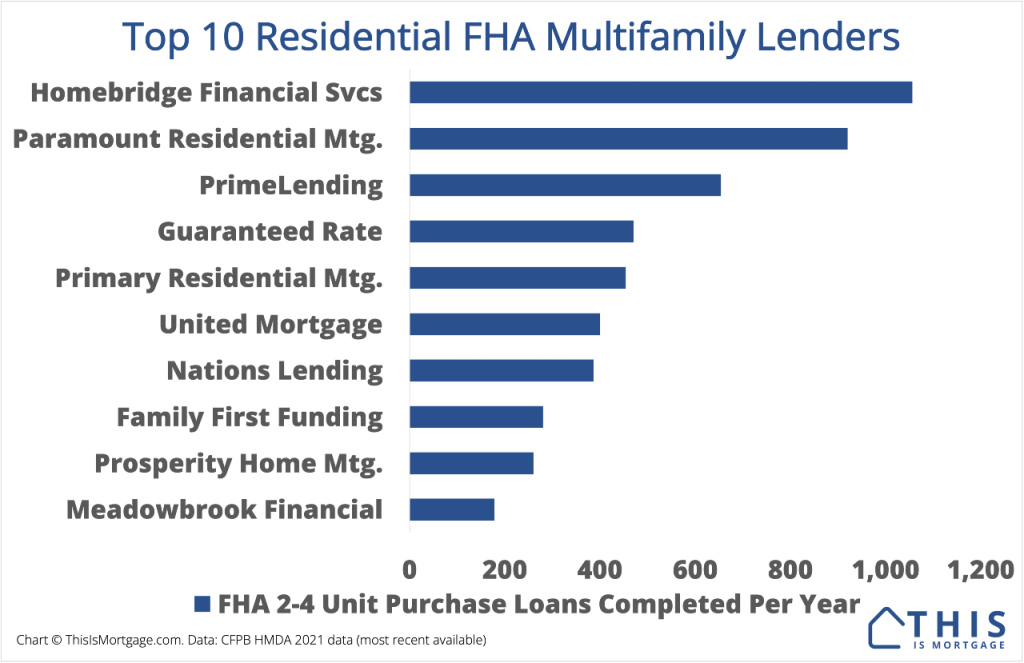

The following are the top 10 residential FHA multifamily lenders in the U.S. according to the Home Mortgage Disclosure Act database.

| Lender | FHA 2-4 unit purchase loans completed per year | Total loan volume |

| Homebridge Financial Services | 1,056 | $251,230,000 |

| Paramount Residential Mortgage Group | 920 | $192,100,000 |

| PrimeLending | 654 | $120,205,000 |

| Guaranteed Rate | 470 | $84,065,000 |

| Primary Residential Mortgage | 454 | $76,505,000 |

| United Mortgage Corp | 400 | $106,900,000 |

| Nations Lending Corporation | 386 | $76,635,000 |

| Family First Funding | 280 | $74,210,000 |

| Prosperity Home Mortgage | 260 | $37,680,000 |

| Meadowbrook Financial Mortgage Bankers | 178 | $54,145,000 |

2021 data, the most recent available.

Are these the best lenders?

Biggest doesn’t always mean best. You may get great service and guidance from another lender.

In fact, what’s more important is your loan officer.

For example, Loan Officer Tom works at a top-10 lender but has never done an FHA multifamily loan. Loan Officer Lauren does 10 FHA multifamily loans per year but works at a smaller company.

A buyer is better off choosing Lauren over Tom.

Interview your loan officer. If they do FHA multifamily loans regularly, they are likely a good resource.

What to look for in an FHA multifamily lender

Technically, any lender that offers FHA loans can offer an FHA multifamily loan. But don’t choose just any FHA lender.

There are intricacies to these loans. If the loan officers and underwriting staff are unfamiliar with them, they might not qualify you for the loan amount you deserve, or might not approve you at all.

For instance, FHA allows you to use future rental income on the property to qualify. The lender must be able to accurately determine how much future income to use for qualification.

There’s also a self-sufficiency test for 3- and 4-unit properties. If a lender doesn’t know how to calculate it, they might advise you to make an offer on the wrong home.

It’s wise to ask a lender how many FHA multifamily loans they’ve done in the past six months before you agree to use them.

Residential vs commercial multifamily

There is also quite a bit of confusion around this topic because “multifamily” can also mean large apartment complexes (5+ units). To make matters worse, FHA also offers commercial financing for those properties.

So when you’re searching for lenders, make sure you are looking at lenders that offer residential FHA multifamily loans for properties with 2-4 units.

Start your FHA multifamily home loan with a reputable lender here.

Where to find FHA multifamily lenders

The best ways to find quality FHA multifamily lenders are:

- Searching real estate investment forums like BiggerPockets and reddit r/realestateinvesting

- Joining local real estate investing Facebook groups

- Asking your real estate agent

- Finding good reviews on legitimate review sites for FHA multifamily loan officers

It’s not advised to call just any loan officer. As mentioned, this is a specialty product. Any loan officer will tell you he or she can complete the loan, but may do it just to get the deal.

Seek out a pro who really knows this product.

Shopping for the best rates

It’s understandable to be rate-sensitive on a big purchase like an FHA multifamily home.

However, it’s better to get a slightly higher rate and complete the purchase successfully than to get the lowest rate.

You can find plenty of low rates advertised online. But getting a random loan officer at a big national online lender could spell disaster for your home purchase.

However, there’s still room to shop for rates. Identify 2-3 knowledgeable loan officers and get quotes from them on the same day. They may not be able to give you a written quote without a property address. Still, you can get a sense of their rate structure from a verbal estimate.

Bottom line: Choose an FHA multifamily lender wisely

Choosing a multifamily lender takes a little more upfront work than if you were buying a single-family home. But the rewards of multifamily can make the extra process well worth it.

Connect with a reputable and professional lender and start on your FHA multifamily home purchase goals.