Owning a multifamily property can reap benefits for years, especially if you invest correctly.

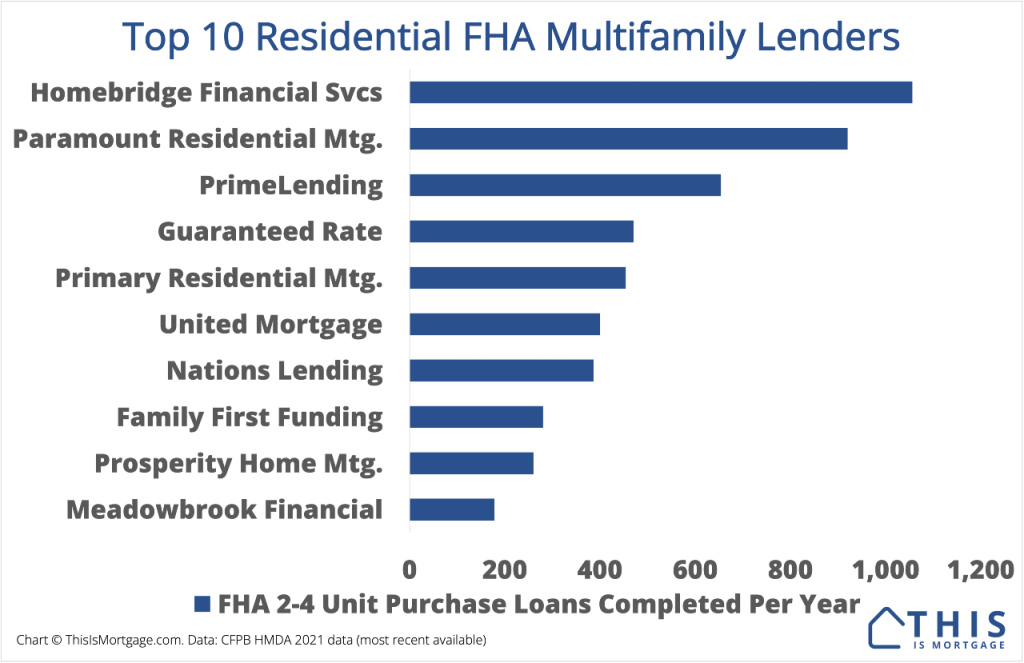

Perhaps the best way to acquire your first multifamily property is to buy a 2-4 unit (residential multifamily) that you plan to live in. Then, you can pay just 3.5% down and get better mortgage rates with an FHA multifamily loan.

However, you can also purchase a multifamily structure, either residential or commercial (5+ units), if you already own a home and are looking to get into real estate investing.

Here are the benefits of investing in multifamily over single-family as a first-time buyer or experienced investor.

See if you can buy a multifamily home.

Better cash flow

A multifamily property can yield cash flow much more easily than a single-family residence (SFR). There are more units, more renters, and higher rental income versus the mortgage payment. For example, if you buy an SFR with a payment of $2,000, you might be lucky just to break even each month. But if you buy a 4-unit with a payment of $4,000 per month, you could rent out each unit for $1,500 per month for $6,000 in rental income. This would net $2,000 per month in cash flow.

Semi-passive income

No real estate is completely passive, but you can eventually earn consistent income without having to clock in every day – and you can’t get laid off. Multifamily is a great way to diversify your income sources and even retire early one day.

Faster scaling

Buying 10 SFRs could take years and mountains of paperwork. Yet, buying a 10-unit apartment building could take just months and not require all that much more paperwork than a single home.

Easier management

Whether you have an owner-occupied multifamily property or a commercial apartment building, managing multiple units in one property is easier than being spread across many single-family homes. If you hire a property management company, fees are likely much less on a per-unit basis than having multiple SFRs.

Efficient maintenance

It’s hard enough to find skilled plumbers, electricians, and contractors. But scheduling them for individual fixes across many SFRs makes it even harder. With a larger property, you can take care of multiple issues at once.

Use rental income to qualify for the loan

If you plan to buy a 2-4 unit (residential) home, you can often use future rent to qualify for the loan. No major loan program allows you to use future rental income from a single-family residence to qualify.

Low down payment and mortgage rates

Those who plan to “house hack” – live in their 2-4 unit investment property – can get a down payment as low as 3.5% and very low mortgage rates. The transaction would be considered owner-occupied, therefore come with much lower qualification standards than a non-owner-occupied or rental property loan.

A new rule for conventional financing is that you need just 5% down to buy a 2-4 unit home.

Higher loan limits

Properties with 2-4 units can be purchased with government-sponsored programs from Fannie Mae, Freddie Mac, or FHA. These loan types come with loan limits, but limits are much higher for multifamily properties.

Offset your mortgage payment

If you choose to live in your multifamily property, you can offset your mortgage payment with rental income, or even live mortgage-payment-free. See how much you can reduce your payment with this calculator.

Lower cost per unit

If you buy a single-family home at $250,000, your cost is $250,000 per unit. If you buy a 4-plex for $600,000, your cost per unit is $150,000. When your initial investment per unit is lower, you have greater ability to generate cash flow.

Tax advantages

Rental income, oftentimes, can be nearly tax-free. That’s because you can write off property depreciation each year, offsetting any rental income. You can also deduct repair costs, management fees, and other costs of running the property from income earned from the property. However, you can’t offset employment income with property costs unless you’re a full-time real estate investor.

Appreciation

With a looming housing shortage, structures that provide shelter are likely to rise in value over time. Many years from now, you may be able to sell the property for a handsome profit. In this way, investing in a multifamily property is a good supplement to retirement savings.

Tenant risk is spread-out

A 1-unit property can be vacant in the blink of an eye. Yet, a property with 3, 5, or 10 units will likely always have at least a few tenants helping to pay the mortgage.

See if you are eligible to start investing in multifamily.

Disadvantages of multifamily investing

There are also plenty of risks to multifamily investments. No investment is risk-free, after all.

All eggs in one basket: If you happen to buy a multifamily property in a declining area, you could have trouble filling it with good tenants. Many SFRs spread through a city or even in multiple cities or states gives you more protection from slow local economies.

Market could turn: Multifamily homes come with larger price tags and mortgage payments. If the rental market becomes difficult, you could end up having a hard time filling up the building, or have to deeply discount rents.

Harder to sell: There will always be a market of interested buyers for single-family residences. There are just so many more people wanting to buy a standard home. If rental markets turn sour, it could be hard to sell the property in a pinch.

More systems: With a 4-unit home, for instance, you have four hot water heaters, four dishwashers, four ovens, and so on. There’s a greater chance of repairs and costs.

Bottom line

Multifamily investing provides too many benefits to list for the right type of investor. Get to know your market and the financing options available to get started on your investing journey.