Your mortgage lender just asked for a letter of explanation of a relationship. Why?

Don’t be alarmed. Usually, this happens when the lender needs to confirm that funds are coming from an approved source.

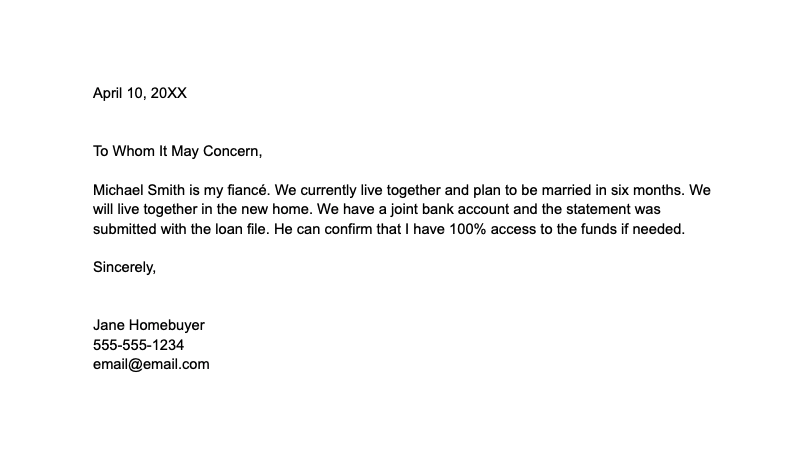

These templates will help you write an explanation letter (LOE or LOX) for the underwriter.

Letter of explanation of relationship: Downloadable Word, Google Doc, PDF Templates

>>Download the Word document here

>>Download the PDF here (requires PDF editor to edit)

What is the lender looking for in my explanation of relationship?

All mortgage types have rules about where money for a mortgage transaction can come from.

If you are getting a gift or are on a joint bank account, the question may come up. The underwriter needs to document that the individual is a family member, fiancé, fiancée, or otherwise had a prior relationship with you not having to do with the real estate transaction.

The real estate agent, seller, builder, or other parties involved in the transaction can’t give you money toward your down payment. They have a financial interest in the transaction closing.

People in these roles can give you a closing cost help only, and only up to certain limits, typically 3-6% of the home’s price.

“Interested party contributions,” as they are known, need to be tracked since they can alter the true value of the home.

Typically, a quick gift letter can take care of the relationship question as well.

Speak to a lender for personalized help.

Digging into an unfamiliar name on a statement

Underwriters are trained to explain and document anything that seems out of place in a loan file.

For instance, you submit a bank statement with someone else’s name along with yours. You didn’t list any dependents or a spouse on the application.

The underwriter could ask who this is to make sure you have 100% access to the funds. They might also ask this person to confirm you can access funds.

Any document with a “random” name on it (in the underwriter’s view) could be questioned.

The underwriter could be checking household income

Certain loans like USDA limit you to a maximum household income, including everyone in your current household even if they are not on the application.

An underwriter might ask about your relationship to someone found on a lease agreement or utility bill to determine whether they are an undisclosed member of your household.

If they will be living with you in the new home, they might push you over income limits.

Start your home loan or get a second opinion from a lender.

Verifying the relationship of an interested party to the transaction

The underwriter might suspect that a seller, agent, or another party to the transaction is a relative. This requires disclosure upfront since this is known as a “non-arms length” transaction. Some lenders don’t allow these.

For example, buying a home from your brother could lead to a lower or higher home price than the market value. A lower price isn’t usually an issue, but a higher price could indicate mortgage fraud — getting a larger loan than the home warrants.

What types of relationships are okay for down payment gifts?

Usually, you can disclose your relationship without any issues. But, be prepared in case you are getting a down payment gift from someone who is a party to the transaction.

For instance, if your mother is also the real estate agent, it’s likely she won’t be allowed to give you a down payment gift. Here are gifting rules.

Conventional

Acceptable relationships for gifts:

- A spouse, child, other dependent

- Anyone related by blood, marriage, or legal guardianship

- A non-relative who is a domestic partner or a relative of a domestic partner

- Someone who is engaged to be married to the borrower

- A former relative

- A godparent

An agent, seller, or another interested party can’t give a down payment gift even if they are one of the above. They could give a closing cost credit within limits, though.

Check with a lender to see if you’re eligible for a conventional loan.

FHA

Acceptable relationships (as long as they are not also a party to the transaction):

- A family member

- Your employer or labor union

- A close friend for whom you can document a relationship not having to do with the transaction

- A charitable organization

- A government agency or public entity providing assistance to low- or moderate-income families or first-time buyers

Closing cost credits are allowed up to certain limits if a relative is also an interested party to the transaction.

VA

Any relationship is acceptable as long as the person has no affiliation with any interested party to the transaction.

USDA

Anyone who does not stand to benefit from the sale can give a gift.

Run your scenario by a lender.

Can I always get a gift from an eligible donor?

In some cases, the lender won’t allow a gift, even from an eligible donor as defined above. In these cases, the relationship to the donor doesn’t matter because you can’t get the gift anyway.

Minimum investment amount

Certain transactions require a minimum investment from the borrower’s funds. For instance, Fannie Mae requires a minimum contribution from the borrower of 5% on a 2-4 unit home or vacation property with less than a 20% down payment.

Reserve requirement

Most loan types do not allow you to receive a gift to cover financial reserves after closing. For instance, you may need two months of reserves for a $2,500 payment: $5,000 of your own funds.

Relationship letter of explanation for those on the loan application

The lender should not ask for a relationship letter for someone on the loan application. Two people can buy a home together whether or not they had a prior relationship.

In fact, a lender is wading into discriminatory waters if they are asking about marital status.

Ask your loan officer the reason for the request if it’s about a co-borrower. Maybe there’s a valid reason, but it’s unlikely.

Letter of explanation of relationship for mortgage – FAQ

The lender may need to verify the giftor falls within an acceptable relationship type. Some programs require the giftor to be a relative, domestic partner, or someone you’re engaged to.

The lender should not ask you about your relationship to someone on the loan application. You can buy a house with any individual whether or not you are married to them or had a relationship prior to the transaction.

The lender won’t deny the mortgage application for the relationship itself. However, only certain people can give you a financial gift for the down payment, such as a relative or fiancé. Furthermore, the underwriter might be checking whether a current household member will be living with you in the new home, which could put you over income limits for USDA or another program that imposes income limits like Freddie Mac Home Possible.

A relationship letter for a mortgage is not a big issue

It’s always scary to get a request from your lender when you’re not sure how to answer or why they are asking.

Fortunately, a relationship letter is not something to be too worried about.

Be sure to disclose relationships to interested parties to the transaction upfront. In most cases, though, a lender doesn’t care about personal relationships except how they might conflict with lending rules.

Get a second opinion or additional help from a reputable lender here.