Most people love the idea of investing in real estate. There are so many upsides: property appreciation, rental income, and the pride of running a small business.

There’s just one big ugly enemy that keeps most people from doing it: fear.

Here’s how to safely invest in property using an owner-occupied mortgage loan.

Speak to a lender now to see if you can buy a multifamily home.

- What is owner-occupied multifamily investing?

- Advantages of buying owner-occupied multifamily

- Owner-occupied multifamily disadvantages

- Best owner-occupied multifamily financing options

- 1. FHA loan

- 2. Fannie Mae Conventional

- 3. Freddie Mac Conventional

- 4. VA loan

- How to buy a multifamily property

- Use future rental income to qualify

- Getting loan assistance buying a multifamily property

- Alternatives to owner-occupied multifamily investing

- Can you buy a multifamily property if you already own a single-family?

- Reducing your investing risk with an owner-occupied loan

- Owner-occupied multifamily financing FAQ

- Bottom line

What is owner-occupied multifamily investing?

In short, owner-occupied multifamily investing is when you purchase and live in a multifamily (2-4 unit) home and rent out remaining units.

This strategy opens a massive loophole for those who want to start investing but lack the typical 25% down required for an investment property.

A duplex, triplex, and fourplex is considered “residential property” by major government-backed agencies like FHA, Fannie Mae, and Freddie Mac.

Because the property checks out as “owner-occupied” and “residential”, you can finance up to 96.5% of the purchase price, also known as 3.5% down, with an FHA multifamily loan. And, as of November 2023, you can get a conventional multifamily loan with 5% down. More on loan programs later.

This type of financing is more affordable and allows you to begin your real estate investing career with very little down and at low personal risk. Let’s find out how.

Request a call from a lender to see if you can buy a multifamily home.

Advantages of buying owner-occupied multifamily

Owner-occupied real estate investing, or “house hacking” as it’s come to be known, is the absolute best way to get started in real estate.

It’s somewhat surprising that big government housing agencies still allow you to buy a multifamily property up to four units at owner-occupied mortgage rates and down payments. Take advantage of this loophole while it’s still allowed. Here’s how you can benefit.

Set yourself up for financial independence: Inflation is your friend. Rents rise but your mortgage payment stays the same.

Live in the home for 12 months: If you don’t love the idea of living a wall away from your tenant, you only have to live in the property for 12 months to meet the owner-occupied rule.

Future cash flow: As rents rise and your mortgage stays the same, your property will cash flow more and more, eventually paying your living expenses.

Offset your mortgage payment: What would you rather have? A single-family home with a payment of $3,000 per month with zero rental income, or a triplex costing $5,000 per month with $3,000 in income? The triplex costs you $1,000 per month less than the single-family.

Related: Run multifamily vs single-family scenarios with this calculator.

Cut 10-15 years off of your investing timeline: If you buy a single-family home, it could be over a decade before you establish enough income and savings to qualify to buy a separate investment property. Jump in at year 1 with owner-occupied multifamily real estate.

Get access to higher loan amounts: FHA and conventional loans allow larger loan amounts for 2-, 3-, and 4-unit properties. With FHA, you can get a $900,000 loan for a fourplex anywhere in the country, and up to $2 million in expensive locales.

Get landlord experience early: Some loan programs require you to have two years of landlord experience before you count any rental income on a property you are vacating. Within two years, you can move out of the multifamily property and use its rental income to offset its payment, making it easier to qualify for the next home.

Get help from Uncle Sam: Government-run agencies like FHA literally subsidize your investing journey by giving you a super-low mortgage rate and low down payment.

Owner-occupied multifamily disadvantages

No worthwhile investment is without downsides. Some days you will wish you bought a regular old single-family home because tenants can be difficult. Still, those who can handle it come out way ahead.

Learning curve: You’ll be learning to be a homeowner and a landlord all at once. You can get a head start by studying the best strategies for landlords on sites like Bigger Pockets. Others have made plenty of mistakes – there’s no reason you need to as well.

Liability: There’s always a risk of lawsuits when you rent out a property. Consider getting a good umbrella insurance policy. Hire a lawyer to draft your lease agreements.

Awkward conversations with your neighbor/tenant: One of the most creative pieces of advice on Bigger Pockets is that you should pose as the property manager who represents the owner. That way you don’t have to be the bad guy when correcting your tenant on their behavior. You could also hire a property management company to be the “bad guy.”

While the pros far outweigh the cons, you should go into your venture fully aware of inconveniences, awkward moments, and tough conversations that you will experience as a landlord.

Speak to a lender to see if owning a multifamily home is right for you.

Best owner-occupied multifamily financing options

Now that we’ve dispelled fears and seen that residential owner-occupied multifamily properties are a solid investment, let’s find out how you finance them.

Buying an owner-occupied multifamily property means getting better rates, lower down payments, and more favorable financing terms.

As mentioned, if you go to a lender today and ask for a “non-owner-occupied” loan or “rental property loan” they will make you pay 20-25% down and charge you a sky-high rate at least 1-2% higher than owner-occupied rates.

This is because non-owner-occupied loans are considered riskier. A landlord will stop making payments on his rental home before his primary home.

But you are buying an owner-occupied home, even if it does have extra units you plan to rent out. Therefore, you get the red carpet rolled out for you and a crown practically placed on your head. The advantages of owner-occupied financing can’t be overstated.

Here are the best owner-occupied multifamily financing options.

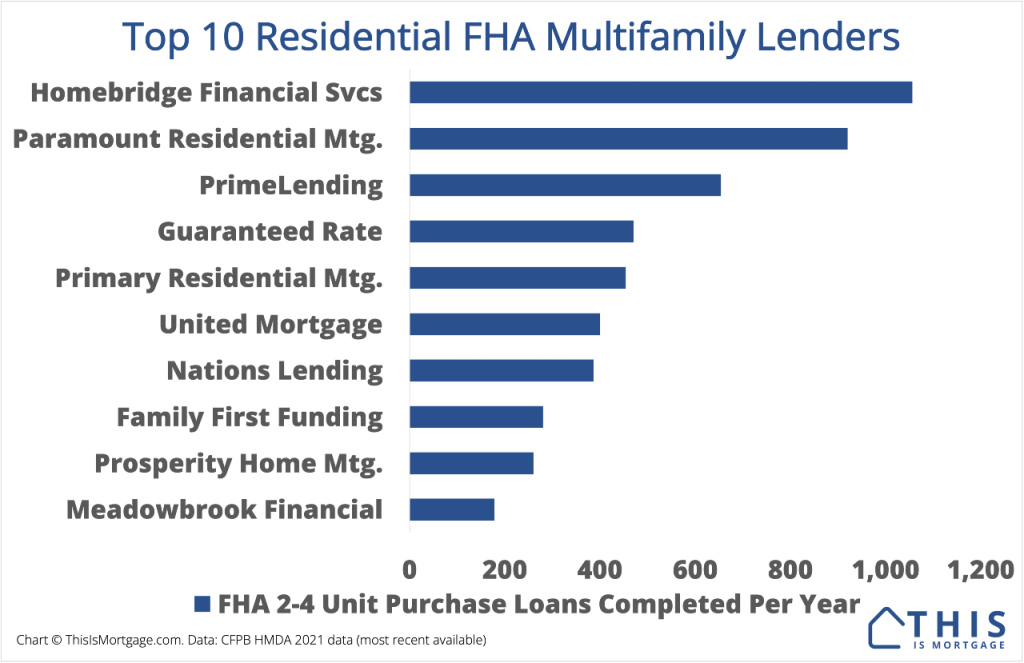

1. FHA loan

FHA multifamily loans require just 3.5% down. You can have a credit score as low as 580 and still qualify, though some lenders may require a higher score. You can use future rental income to qualify even if you have zero landlord experience. You can have a debt-to-income ratio of more than 50% in some cases, meaning your payment can be over half of your gross income, letting you qualify for more home than with a Fannie Mae or Freddie Mac conventional loan.

However, know that if you buy a triplex or fourplex, the property will need to pass FHA’s self-sufficiency test showing that the property’s potential rent can support the full payment.

Live in an expensive area? Unbelievably, you can get an FHA loan of over $2 million for some multifamily properties in many areas of the country.

Contact a lender to start on your FHA multifamily pre-approval.

2. Fannie Mae Conventional

An owner-occupied conventional loan isn’t quite as flexible as FHA, but can be the best program for those with high income, a bigger down payment, and great credit.

To buy a 2-4 unit home, you’ll need 5% down which is a new rule effective November 2023. Prior to this drastic reduction in down payments, Fannie Mae required 15-25% down. It’s a great time to take advantage of a conventional loan for multifamily investing.

Find out more about the 5% down conventional multifamily loan.

3. Freddie Mac Conventional

As of yet, Freddie Mac does not offer 5%-down multifamily investing unless you meet income limits for the Home Possible program. Most won’t qualify for a multifamily loan at this income. So far, Freddie Mac still requires 15% down for a 2-unit and 20% down for a 3-4 unit.

4. VA loan

Those with current or former military service have access to an incredible owner-occupied financing option: the VA home loan.

It requires zero down, even for 2-4 unit properties. It also offers below-market rates, no monthly mortgage insurance, and lenient credit score standards. While it’s hands-down the best multifamily loan on the market, you have to have at least 90 days on active duty or 2 years of former U.S. military service to be eligible.

Check your multifamily financing options by speaking to a lender now.

How to buy a multifamily property

Buying a multifamily is similar to buying a single-family residence.

- Budget: Make sure you have the income to support the payment and are comfortable taking on a large home payment. Ensure your budget allows for extra expenses like maintenance and if you can’t rent a unit for a few months.

- Pre-approval: Get a pre-approval from a lender. This tells you what you can qualify for, making some assumptions about future home price, rental income, and other costs. You can start your pre-approval here.

- Hire a real estate agent who is well-versed in multifamily homebuying or house hacking. A general real estate agent may not be able to guide you to the best deals.

- Shop for multifamily properties. Examine the local rental market and ask your agent how much the units will rent for and if there’s strong demand.

- Make an offer on the right home. Expect fierce competition from all-cash investors and experienced buyers with large down payments. You’ll likely need to make offers on many properties. If you can’t find a turn-key home, use an FHA 203k rehab loan to buy and repair the multifamily home.

- Get current lease agreements from the seller when your offer is accepted. The lender will order an appraisal and gather any documents not collected from you during the pre-approval process.

- Complete the transaction. When the loan “funds,” the home is officially yours. Honor any existing rental agreements, although you should be able to displace one current tenant for owner-occupancy. Make sure the tenants know to pay rent to you.

- Create new leases when current ones expire showing you as the landlord. Manage the property, be firm but fair with tenants, and you’ll have an additional long-term source of income.

Start your multifamily journey by connecting with a lender now.

Use future rental income to qualify

One of the biggest advantages of a multifamily purchase is that lenders allow you to count future rental income on the property to qualify for the loan.

For instance, you’re buying a duplex with a total payment of $3,000 per month. You get a market rent analysis (included with the appraisal) that says you can rent one side for $1,500 per month. You can count 75% of the market rent, or $1,125 per month. In this example, the lender adds $1,125 per month to your employment income to help you qualify.

In some cases you can qualify for a multifamily when you can’t qualify for single family, thanks to using future rental income.

Getting loan assistance buying a multifamily property

You can get down payment and closing cost assistance to help you buy a multifamily home.

Down payment assistance

You can get well over $10,000 to help with your down payment in many areas of the country. There are down payment assistance programs in every state. They are highly local, some applying to a certain city or county. They all have different rules. By researching programs in your area, you could get funds to apply directly to your down payment requirement.

For example, if you were buying a $400,000 duplex with an FHA loan, the minimum down payment would be $14,000. But if you received $10,000 in assistance, you would only pay $4,000 of that from personal funds.

Two nearly nationwide programs are as follows:

- FHA Fast 100: Lets you finance your 3.5% down payment. Duplexes allowed, but no 3-4 units

- DPA Advantage: Covers your entire FHA 3.5% down payment with a grant. Allowed on 2-4 unit properties

Request a call from a lender about down payment assistance.

Closing cost assistance

Closing costs are about an extra 2-5% of the home’s price. These costs are for the appraisal, escrow services, credit report fees, property taxes that you prepay, and other costs of setting up the loan. However, you can request closing cost assistance from the seller to reduce your upfront cash outlay. Learn the strategies I used to reduce my out-of-pocket expenses on my first home

Gift funds

You can accept gift funds from family and even friends in some cases. If your parents or another relative is willing to help you buy a home, they can give you 100% of the down payment funds. That’s essentially like getting a zero-down loan for your multifamily investment!

Alternatives to owner-occupied multifamily investing

If you’re not quite ready to make the leap into multifamily investing, there are smaller baby steps you can take.

- Rent out a room: You can buy a single-family home that’s slightly too large for your needs and rent out a room. In fact, you could rent out the entire house and live in one room if you’d like. You may not count future rental income to qualify in this case.

- ADU: You could also find a single-family home with an accessory dwelling unit (ADU). A new rule from FHA as of October 2023 is that you can use future rental income from an ADU to qualify for the loan.

Can you buy a multifamily property if you already own a single-family?

You may have already purchased a single-family home, but are considering moving into a multifamily home.

While this is possible, there are some things to be aware of.

First, you can’t have two owner-occupied homes. The lender will assume you’re buying an investment property. You would have to sell the current home or prove you will rent it out.

Second, to use FHA, you can’t have “adequate housing” already. So you could sell your current home. Or, if you plan to keep and rent it, you have to make a good argument on why your current home is inadequate. For instance, you recently had a child and the duplex has 3 bedrooms in one unit, while your current single-family home is a 2-bedroom. Or, the property might be closer to work or family. The lender may accept any number of reasons for the move.

Reducing your investing risk with an owner-occupied loan

Residential property is the safest real estate in which to invest. “Residential” is defined as 1-4 units. Anything with 5+ units is considered commercial.

- Residential: 1-4 living units

- Commercial: 5+ units

You can save a lot of time by eliminating any 5+ unit homes from your search. You can’t get low-down-payment, owner-occupied financing for these, and they don’t come with the same borrower protections.

For one, many commercial loans are recourse loans. Residential loans, for the most part, are non-recourse.

Recourse vs non-recourse loans

A “recourse loan” means the lender can come after your personal assets – retirement savings, cars, furniture, other properties, kids (just kidding) – if you default on the loan. You don’t want this type of loan. This is reason enough to stay away from commercial property and loans for now.

A “non-recourse loan” is one where the lender can only take the property. This sounds bad, but your losses are limited to the property itself in the case of a major recession or medical event where you can’t make the payment. The lender can’t come after personal assets. There are non-recourse commercial loans as well, but they are less common.

Non-recourse loans such as FHA, VA, Fannie Mae, and Freddie Mac are perfect first-time investor tools because they limit losses in case of the worst-case scenario.

Living in the structure you’re renting out

Still another protection of owner-occupied multifamily investing is that you can keep an eye on the property.

Problems arise for absentee landlords. The tenant knows they’ll never come by, so why should they take care of the place?

But if the landlord is next door, the tenant is more likely not to be a hoarder, sell meth, or whatever other horror stories you’ve heard. And if they break terms of the lease, you can evict them immediately.

Owner-occupied multifamily financing FAQ

You can purchase a multifamily home that you plan to live in for 3.5% down with an FHA loan. As of November 2023, you can get conventional financing with 5% down.

You must live in the home for 12 months to meet owner-occupancy requirements.

Yes, you can buy a 4-unit home and live in one unit and rent out the rest. This is still considered an owner-occupied property.

Bottom line

Most people with decent income and credit can take the first step in real estate investing with an owner-occupied multifamily home. But, most won’t, due to the fears addressed at the beginning of this article.

Will you be one of the few that actually does it?