Mortgage lender asking about your commute?

Don’t worry; it’s normal. The lender is verifying two things:

- That the home will be your primary residence, not a second home or investment property.

- That you can get to the office as often as your employer requires.

The kind of commute letter you need depends on what the lender asks for.

Some underwriters might ask for a letter from your employer confirming that the commuting arrangement is acceptable. Or, the underwriter might ask for an explanation from you about why you are buying so far away and how you will commute to work.

Below are samples of both kinds of commute letters.

>>Related: Sample Letter of Explanation for Remote Work<<

Find your lender in a few easy steps.

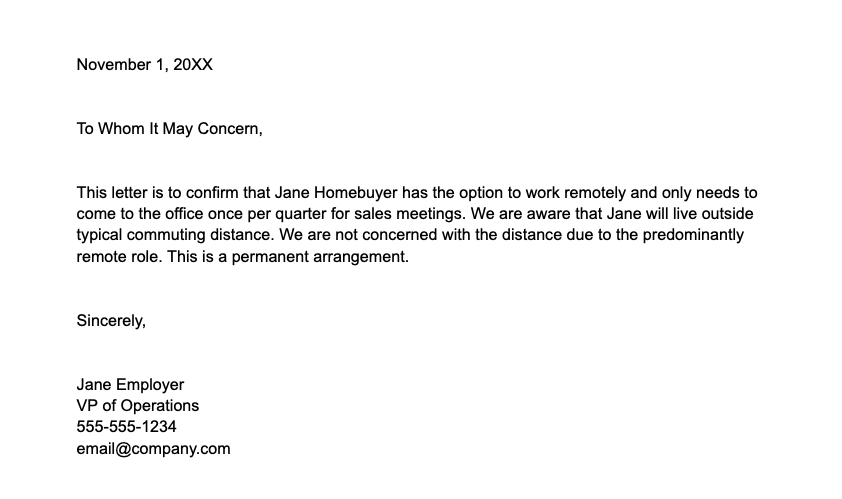

Downloadable sample mortgage letter of explanation for commute from your employer

The lender will usually accept an employer letter sent by you as long as it’s signed by your manager or HR department.

>>Download the Word document here

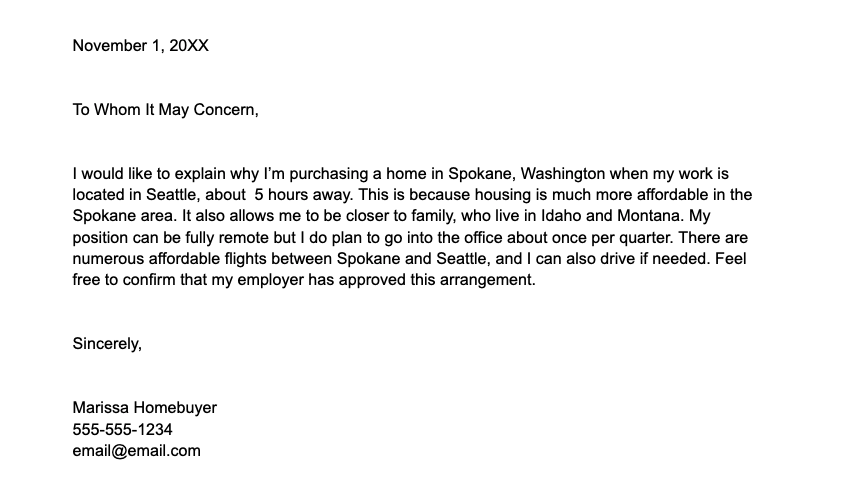

Downloadable sample mortgage letter of explanation for commute from the borrower

>>Download the Word document here

Why do lenders need a letter of explanation for my commute?

As mentioned above, there are two reasons lenders ask about your commute.

1. To document continuity of income

Most major mortgage rule-making agencies like Fannie Mae, Freddie Mac, and FHA, require the lender to make a case that the borrower’s source of income will continue.

These agencies do not state maximum commuting distances. Rather, they require the lender to question potential issues with ongoing income, such as an employee who can’t get to work.

In most cases, a letter of explanation or “LOE” stating why you plan to live so far from your employer will do the trick. Make sure your employer has approved your remote work status and knows about your plan to manage a long commute.

Get personalized help from a lender.

2. To make sure the property is a primary residence

Investment properties and second homes come with more risk. Naturally, home buyers would like to call an investment property a primary residence if they can.

But lenders are aware of this strategy and will investigate any evidence that the borrower may not live in the home.

Buying a home that’s located far from your employer will raise red flags with the lender. The lender in turn will ask for an explanation. If your reason for living far away sounds reasonable, your loan will likely be approved as a primary residence.

Mortgage letter of explanation for commute FAQ

There is no official policy on commuting distance from lending agencies like Fannie Mae. Most agencies require lenders to verify stability and continuity of income. If the lender believes your commute time jeopardizes future income, it will ask for a letter of explanation for how you will manage the commute, or that you are a full or partially-remote employee.

No, you can just inform your lender that you are a permanent remote employee. Your employer may have to write a letter confirming remote status. Find a template here.

Explain how you will manage your long commute. For instance, you might only be required to go into the office once per month, or you may plan to work off hours when there is no traffic, easing your commute time. Your commute needs to sound realistic and feasible to the lender.

Get approved by explaining your commute

A commute explanation for a mortgage may sound intrusive, but your lender is following guidelines coming down from the major lending agencies.

With a quick letter from you and/or your employer, you’d be surprised how quickly your loan will be approved so you can complete the loan and move into your new home.