Your lender asked for a letter of explanation regarding an inquiry on your credit report.

Not to fear. This is normal. The lender needs to know you haven’t opened any additional credit accounts which could affect your debt-to-income ratio.

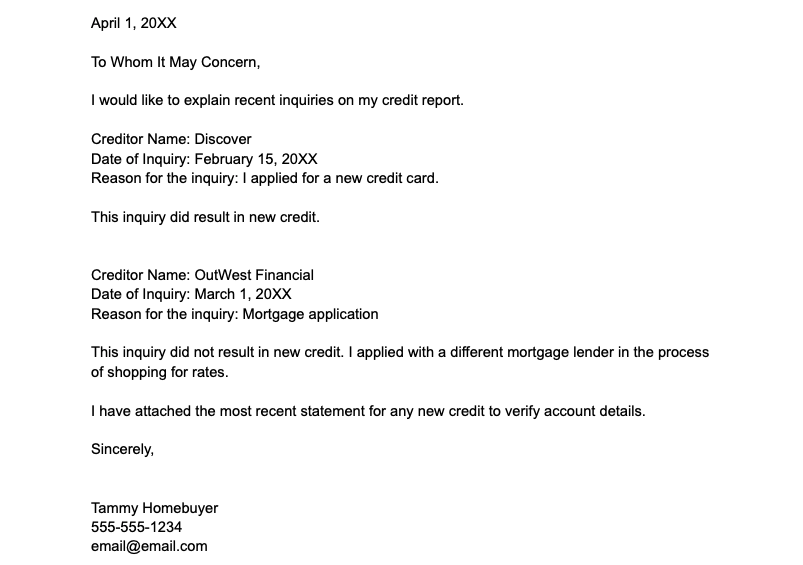

Here are templates to help you address credit inquiries.

Run your scenario by a lender.

Credit inquiries LOE – Word, Google Doc, fillable PDF templates

>>Download the Word document here

>>Download the fillable PDF here

What is the lender looking for in my credit inquiries explanation?

An inquiry happens when you apply for credit. The creditor inquires with the credit bureaus. An “inquiry” is created on your report each time.

The lender only needs to know whether the inquiry resulted or will result in new debt.

New debt would result in a payment, which affects your debt-to-income (DTI) ratio. A large enough payment can push you over DTI maximums, making you ineligible for the loan.

The lender wants to know

- The reason for the inquiry (why you applied for additional credit)

- Whether the inquiry resulted in new debt

For instance, you plan to get new furniture for the home you’re buying. While you’re looking, the salesperson convinces you to buy on store credit. That new debt payment needs to be added to your debt ratio before the loan closes.

Get personalized help from a lender here.

Mortgage shopping causes additional inquiries

Sometimes multiple inquiries show up because you shopped around for the best rate. These won’t affect you. It’s obvious why you had the inquiries.

Simply state on the explanation letter that you were shopping for the mortgage before deciding on your current lender.

Other inquiries where you didn’t open an account

Other circumstances aren’t so clear-cut.

On your letter of explanation, state that no new accounts were opened. Just be sure to explain why you applied but didn’t go through with it.

Be truthful here. The lender will pull a fresh credit report the day of closing. If a new debt shows up, the lender must re-approve the entire file, taking days or weeks.

What if I opened a new credit account?

It’s very common. People get new credit cards and charge furniture on credit – and even buy new cars – in the midst of buying a home. We’re human and we make mistakes, right?

The first step is to see whether the new payment will cause a mortgage denial. A large car payment certainly could.

If that’s the case, you’ll either have to delay homebuying or reverse the purchase, if possible. Car dealerships aren’t excited to take a car back after a sale, but that’s what you might need to do.

However, a new credit card with a $10 payment likely won’t affect your approval.

Speak to your loan officer and come up with a plan.

Get help from an experienced loan officer here.

Hard inquiries vs soft inquiries

Hard inquiries are ones where a creditor checks your credit to open a new account.

Soft inquiries are credit checks not having to do with new credit. They may not even show up on your credit report. For instance, an insurance company might pull credit to determine your premiums.

Lenders typically only ask about hard inquiries. Even if they ask about soft inquiries, you can easily explain them.

Sample letter of explanation for mortgage credit inquiries – FAQ

No. Underwriters expect that a mortgage applicant will shop around for the best rate. These inquiries are not a concern.

Be honest. Perhaps you had second thoughts about a new credit card or car purchase after applying. Just explain why you didn’t go through it.

Not directly. Too many inquiries from creditors can lower your credit score, making approval harder. However, the lender’s primary concern is that you opened a new credit account. This could result in a large monthly payment and push you over debt-to-income limits.

Credit inquiries are not usually a big issue

Most of the time, inquiries on your credit report are not a concern.

Just be upfront about the inquiry and whether new debt was created. Most of the time, your application will maintain its approved status and you can move on with the rest of the process.