Buying a multifamily property such as a duplex or an apartment building comes with huge advantages like semi-passive cash flow and lower cost per unit compared to single-family.

And, there are safe ways to invest, especially in owner-occupied 2-4 unit multifamily homes.

However, any multifamily property will require a very big upfront investment. Plus, you are not very diversified as you can be with a portfolio of mutual funds for instance.

So, what are the risks of investing in multifamily property?

See if you can buy an owner-occupied multifamily home.

Vacancy risk

Likely your biggest risk is not being able to rent out units in your building. This could happen for a number of reasons. Perhaps there are better quality units for the same price elsewhere, the area has a lack of employment, or the unit itself is not adequate for most renters. If you can’t rent the units, you may not be able to pay your costs like the mortgage, maintenance, and taxes. Your costs are required whether or not you have renters.

Falling value

In a down market, multifamily properties may lose value. Suddenly, investors aren’t interested in buying these properties. You may not be able to sell the property if you need to. Buying a residential (2-4 unit) multifamily property may give you more options if you want to sell someday.

Recession

Even though a multifamily property is a recession-resistant investment, there is always a risk of vacancies in a recession. People tend to move back in with parents, get roommates when they would otherwise live alone, or downgrade their living situation. This is why having a class B apartment building or a middle-of-the-road, affordable residential multifamily could be the best move.

Dropping interest rates

People tend to rent when mortgage rates and home prices are high because they can’t afford a mortgage payment. However, if mortgage rates drop, your tenants could find that it’s cheaper to own a property than to rent. Mortgage rates tend to drop during recessions, so there’s a good chance your tenants will stay put. But if rates drop low enough, and your tenants have steady incomes, they might even break the lease to buy a home.

Higher maintenance costs

With a single-family home, you just have one set of systems such as a hot water heater, HVAC, washer/dryer, and dishwasher. However, with a four-plex, you have four times as many things that can go wrong. Plus, it costs more to replace a bigger roof, paint the structure, and more. Be sure you’re prepared to spend more on regular maintenance as well as when things break.

Management

Managing one tenant is hard enough, but things can get complex when managing three, four, or ten. Tenants will start looking to live elsewhere if they are not getting repair requests taken care of. Another risk is that tenants will think it’s okay to pay rent whenever they want, or not pay rent at all, if their are no expectations upfront. Good management is a skill learned through studying best practices and making mistakes.

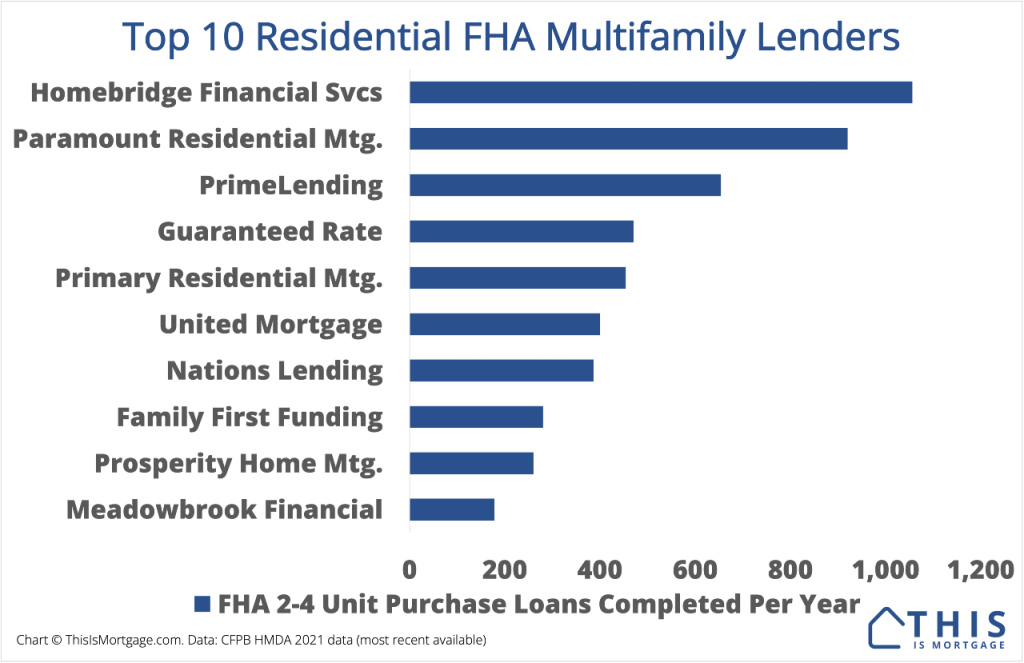

Harder financing

Buying a single-family home is relatively easy, with plenty of zero-down and low-down-payment programs available. But with multifamily property, programs are more limited unless you have 25% down. For a 2-4 unit home, FHA is the best bet for first-time investors, offering 3.5% down. Or, a new rule from Fannie Mae as of November 2023: You can get a 2-4 unit home with just 5% down.

One advantage over single-family is that you can use future rental income to qualify in many cases.

Related: Single Family vs Multifamily Loan Calculator

Non-diversified asset

Buying a set of mutual funds gives you broad exposure to all kinds of markets all over the world. Even owning 10 single-family residences in different markets limits exposure somewhat. But a multifamily property, while it can work out wonderfully, puts all your eggs in one basket. You have one type of investment in one geographic area. That’s why it’s important to make sure the area where you invest has a strong, diversified economy that’s supported by more than one company or industry. Plus, it’s always smart to have adequate cash reserves for an emergency.

Bottom line: risks of multifamily property investment

By being prepared, you can avoid the downsides of multifamily investing and enjoy the many long-term benefits of this strategy.