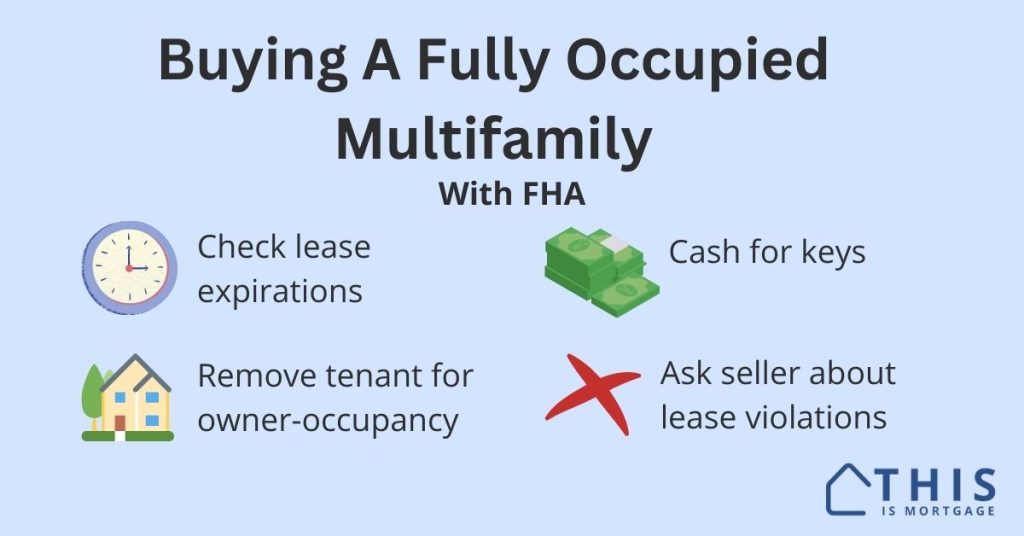

Can You Buy A Fully Occupied FHA Quadplex?

While FHA loans are only for owner-occupied properties, you can buy a quadplex with one of these loans. That’s because FHA considers a property “owner-occupied” when you live in one of the units. This applies even if you rent out the remaining units. But the question arises: what if you find a quadplex that you […]

Can You Buy A Fully Occupied FHA Quadplex? Read More »