FHA Loan Calculator 2024 With Down Payment Assistance

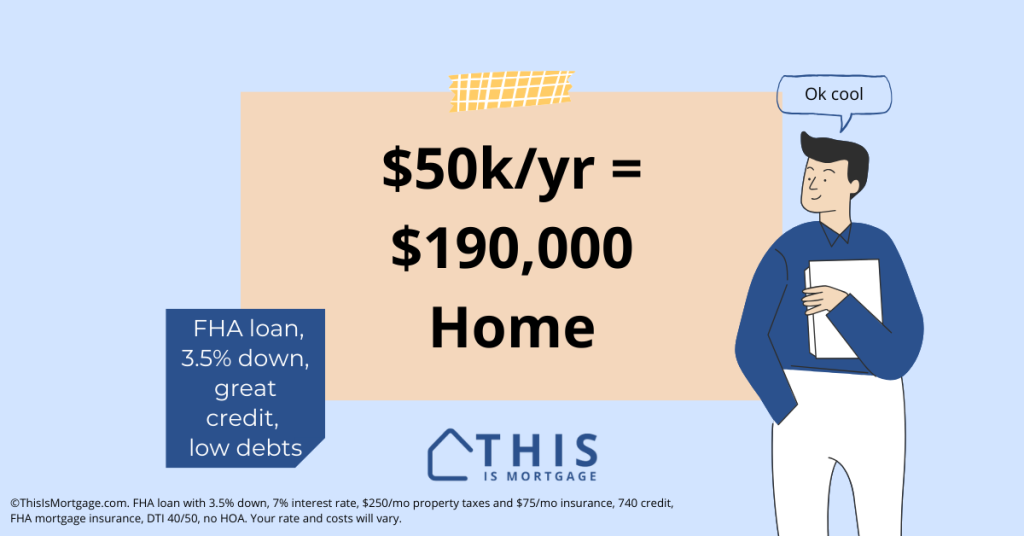

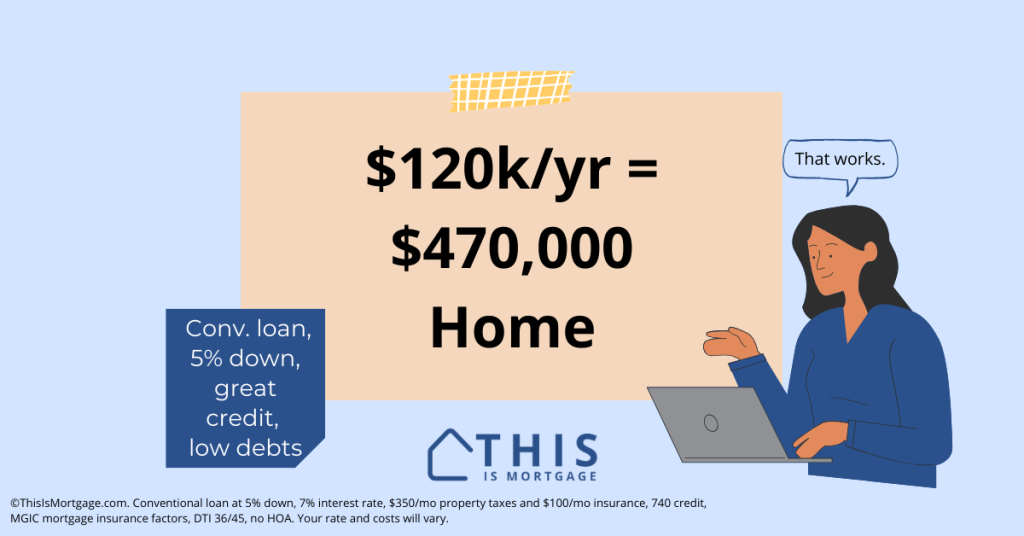

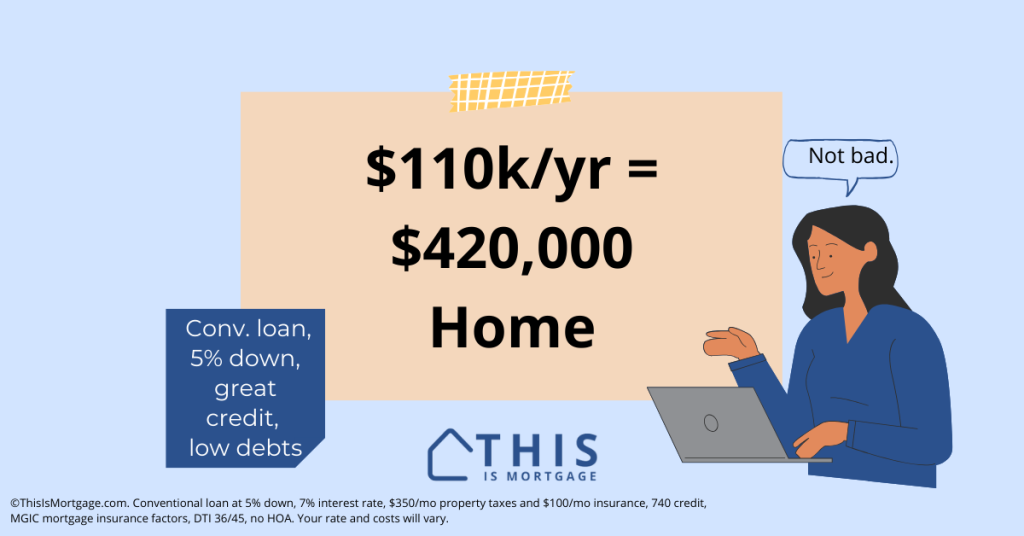

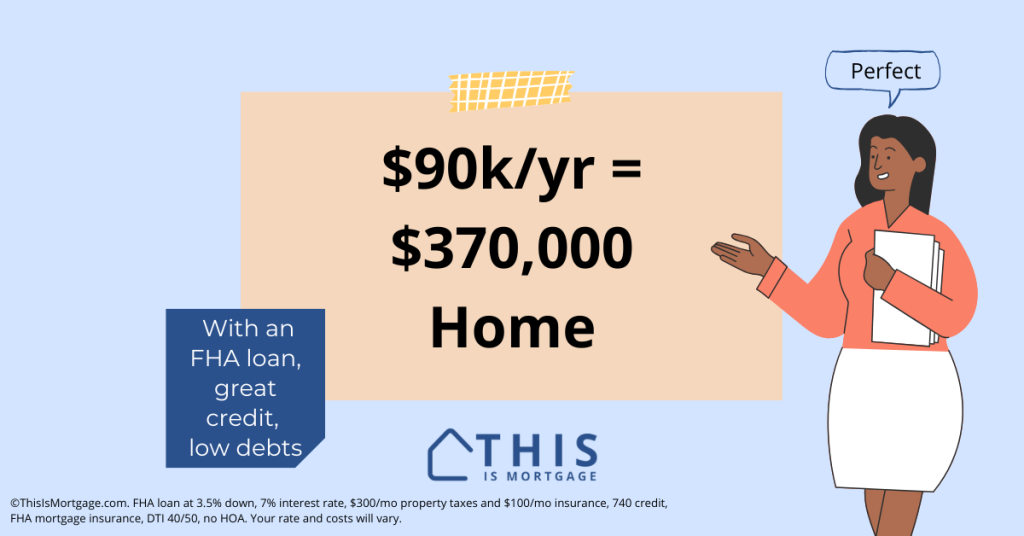

This FHA loan calculator estimates your funds needed to close after applying any down payment assistance and seller concessions. Get an idea of how much you’ll need in savings or other sources to buy a home in 2024. FHA loan primer FHA loans are a favorite of first-time buyers. In fact, over 80% of all […]

FHA Loan Calculator 2024 With Down Payment Assistance Read More »