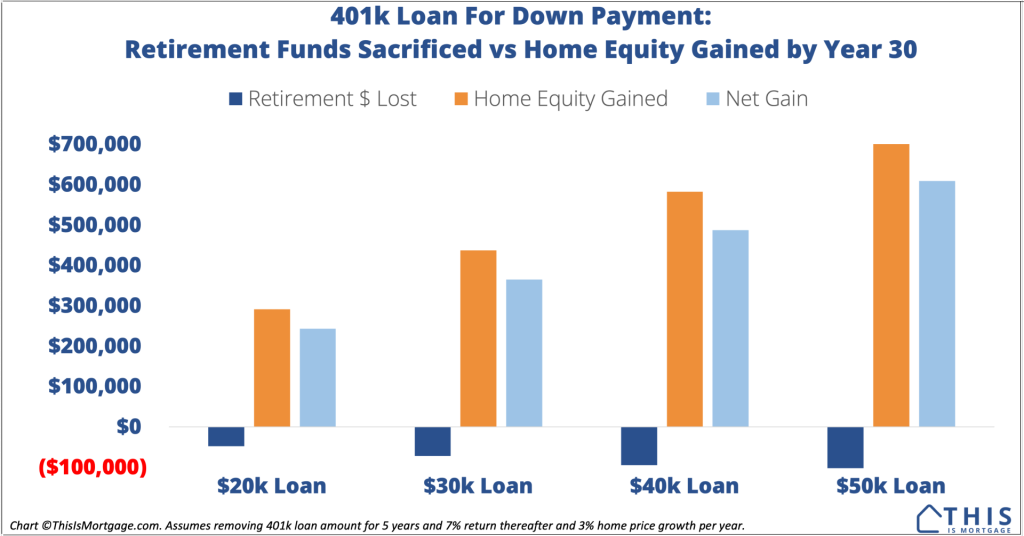

No, a Down Payment 401k Loan Doesn’t Tank Your Retirement. Here’s Proof

If you choose to take a 401k loan, you’re in good company. About 20% of all 401k holders have an outstanding loan on the account, said the Employee Benefits Research Institute in a recent study. Additionally, the National Association of Realtors states that 5% of all homebuyers tap a 401k for their down payment. That […]

No, a Down Payment 401k Loan Doesn’t Tank Your Retirement. Here’s Proof Read More »