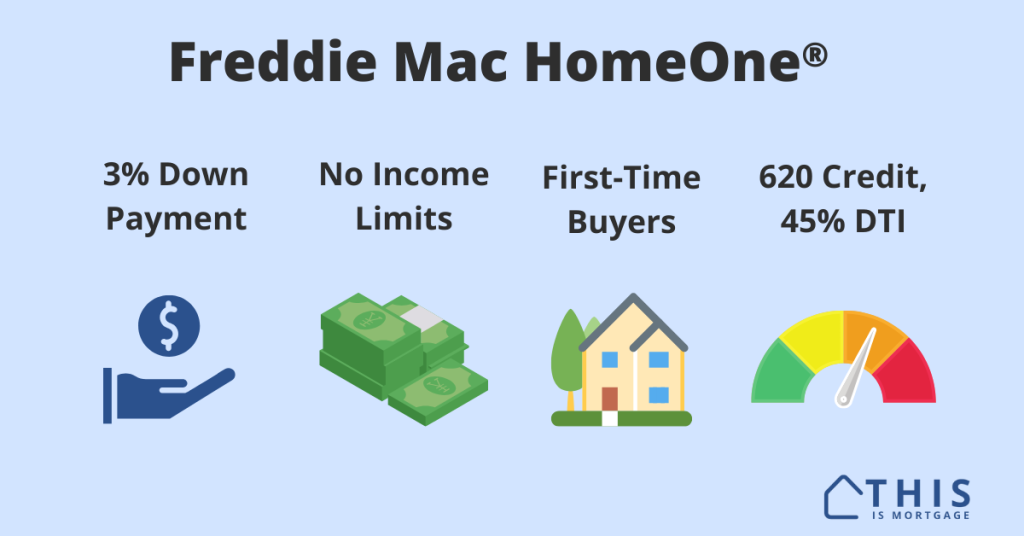

Freddie Mac HomeOne® 2024: 3% Down, No Income Limits

Freddie Mac HomeOne® allows first-time buyers to access a 3% down conventional loan without income or geographic restrictions. This program is a game changer for any first-time buyer who can’t access other programs because they make too much or aren’t buying in eligible neighborhoods. Here’s your guide to HomeOne. Check your HomeOne eligibility with a […]

Freddie Mac HomeOne® 2024: 3% Down, No Income Limits Read More »