Business Owner? Buy a Mixed-Use Building with FHA

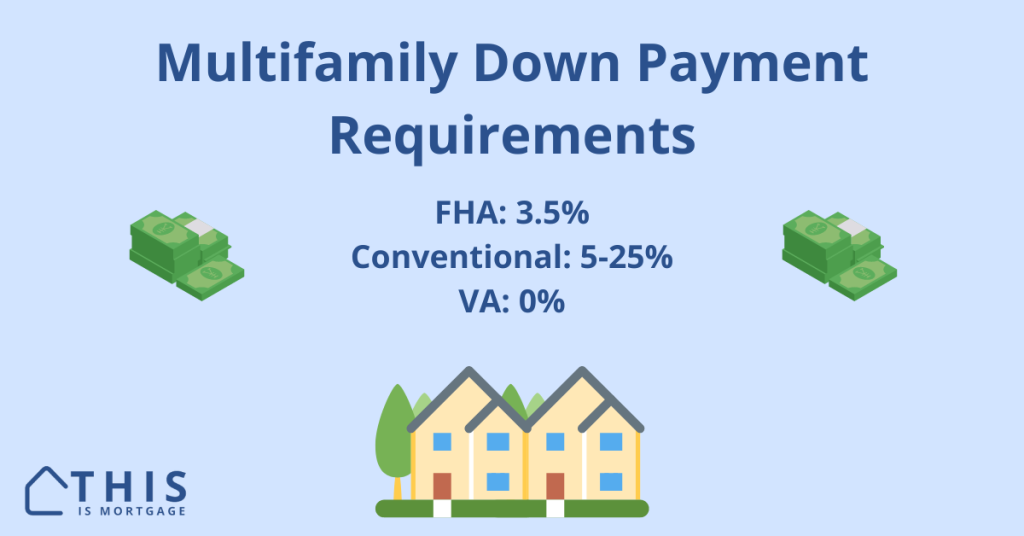

If you’re a business owner, you could purchase a residential property with a storefront or other business-purpose square footage with 3.5% down. Or, you could rent out commercial space to a tenant, offsetting primary housing expenses. Surprisingly, FHA allows a portion of your primary residence to be commercial space. It even lets you finance the […]

Business Owner? Buy a Mixed-Use Building with FHA Read More »