Sample Gift Letter for Mortgage: Downloadable PDF, Word, Google Doc Templates

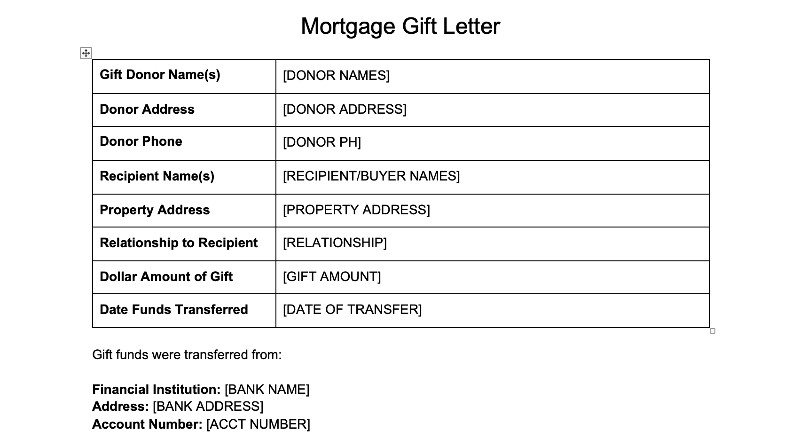

Most major loan programs allow you to use gift funds from family to cover some or all of your down payment and closing costs when purchasing a home. But you’ll need a solid gift letter as well as additional documentation from you and the gift donor. To start, here’s a template gift letter. Submit your […]

Sample Gift Letter for Mortgage: Downloadable PDF, Word, Google Doc Templates Read More »