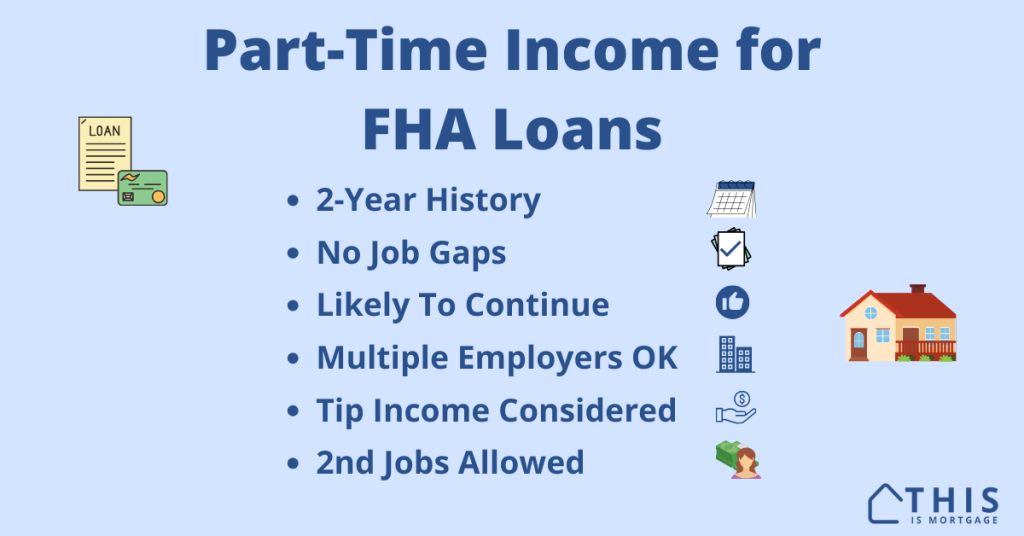

Using Part-Time Income to Qualify for FHA

FHA allows you to use part-time income to qualify for a mortgage. Whether you’re a restaurant server, retail worker, or have other part-time work, your income could help you become a homeowner. Here are FHA’s rules about using part-time income for your mortgage. Check your FHA eligibility. How does FHA define part-time work? FHA defines […]

Using Part-Time Income to Qualify for FHA Read More »